Maintaining precise facts of HELOC purchases

It is extremely important to keep information of all of the deals associated with their HELOC, like the money you’ve made while the desire their HELOC accrued, also invoices and you will bills recording your home improvement costs. This will likely tend to be receipts having materials, work costs, and just about every other costs connected with the new home improvements, solutions or improvements. Staying loans Aspen detailed information from bank comments goes quite a distance on assisting you show their deductions whether your Internal revenue service actually ever issues them.

Fulfilling Internal revenue service conditions

In order to be yes you will be conference most of the standards to own subtracting desire on your own home equity financing or line of credit, it is very important read through the newest IRS’s Guide 936, Home mortgage Appeal Deduction. It publication provides an in depth article on what forms of attract are allowable, what residential property be considered and how to accurately statement the fresh write-offs into the your income tax get back. From the meticulously following the all the direction established from the Irs, you could potentially optimize your deduction for your house security loan otherwise line of credit and lower the possibility of shocks started income tax date.

Limits away from taxation deductions toward HELOCs

Exactly as there are numerous criteria having subtracting notice on your domestic equity mortgage otherwise line of credit, there are even some notable restrictions. This type of limitations are normally taken for what you could spend the cash on to help you actual money restrictions about how precisely much of the eye your can also be deduct.

Mortgage limitations having tax deductions

HELOC notice is deductible for approximately $750,000 away from indebtedness ($375,000 if the partnered filing individually). To have funds and you may mortgage loans applied for prior to , the latest restrict are $one million ($five-hundred,000 when the hitched processing separately). Tax password change altering the newest deduction limitation are set to expire in 2026 and certainly will revert back again to the new $one million maximum or even expanded or else upgraded.

Usage of HELOC financing

The income you obtain from the loan otherwise personal line of credit is employed to have reasonable advancements or framework of your house for the interest are income tax allowable. Such advancements ranges from easy solutions in order to higher-level renovations strategies, but the secret would be the fact such advancements must create worthy of or improve home’s livability. Financing useful almost every other motives, such as settling loans otherwise instructional costs, commonly tax deductible.

Choice Lowest Tax (AMT)

The alternative lowest taxation (AMT) try a certain version of government taxation that applies to specific higher-money anybody. This choice taxation construction is intended to make sure those with a particular number of money is expenses at the least a minimum quantity of fees and can’t take advantage of a lot of deductions.

Until the Taxation Slices and Efforts Work (TCJA) are introduced and introduced into the late 2017, taxpayers who had been subject to the new AMT been able to subtract notice with the to $100,000 off indebtedness ($50,000 if the hitched filing on their own) to possess house equity financing and you may HELOCs if the finance were used to construct or drastically raise a being qualified domestic. Yet not, the new TCJA eliminated all of the deductions related to domestic collateral finance and HELOCs for individuals paying the AMT.

You can find extremely important strategies so you can figuring your HELOC appeal tax deduction and making certain that you’re taking full advantageous asset of so it HELOC income tax work with.

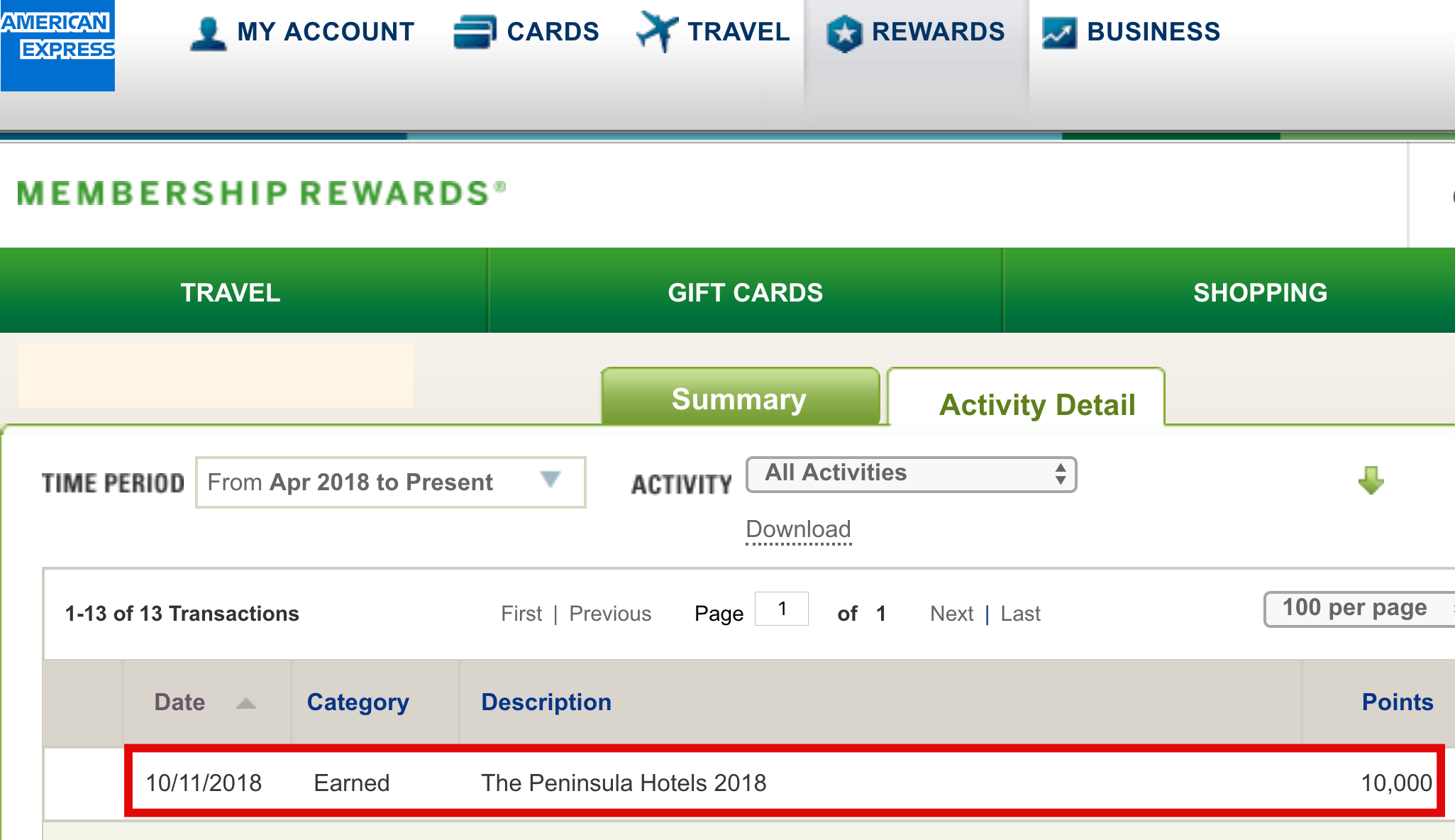

1. Collect their HELOC statements or other called for documents

The initial step is to collect the required documents and you can information. This may involve your HELOC statements, taxation variations and just about every other paperwork pertaining to the new HELOC. Your HELOC statements can assist show simply how much you’ve lent since well since simply how much attention you paid off over the course of certain taxation year.