Before giving a mortgage, very loan providers will remark your application. Regardless if each bank will get rather have different factors, extremely loan providers will consider carefully your entire software before making a decision whether to give.

How old you are

Of several loan providers possess age restrictions that are place at that time regarding a software or pursuing the name ends up. Certain loan providers wouldn’t provide money to people more 50 which is the limit home loan many years or during the their maximum home loan title they could offer for you. Anybody else set the newest limit from the 85. Other lenders don’t have any years restrictions providing you is capable illustrate that you will pay back the borrowed funds.

Their costs

The full month-to-month costs, as chatted about regarding obligations so you can-ration part will additionally be considered when you implement having home financing. This really is conveyed just like the a percentage.

Form of property

Mortgage brokers choose more traditional attributes since they’re more straightforward to promote and then have less structural dilemmas. They truly are cautious with house having thatched roofs and you can timekeeper frames, high-increase flats, ex-regional power property and you can apartments over stores.

Your income resource(s)

Some mortgage brokers favor people who’ve full-day a career to the PAYE earnings. They are going to typically perhaps not offer attractive pricing in order to applicants that have income provide that are not important.

Including the latest mind-employed or people that receive masters. The professionals that people work on can access loan providers exactly who undertake other earnings products.

Am i able to rating an appeal-merely ?three hundred,000 financial?

Yes, you could potentially. An appeal-simply mortgage assists you to spend the money for desire every month doing the conclusion the term. You can expand the interest-only home loan title with a few lenders. Then, you are going to need to pay off the main city or even the entire financing. This could help you support the cost low, nevertheless setting searching for other ways https://paydayloanalabama.com/detroit/ to settle the administrative centre amount.

To obtain an attraction-merely home loan you will need and come up with a larger deposit, perhaps twenty-five% otherwise 29%. This can offset any possible dangers.

You will be needed to features a minimum earnings and you can put down a top deposit, like twenty-five%. While lenders will accept less deposit, such as for example 15%, you may still find conditions.

You prefer the right assets and enough rental income to pay for at least 125% of your own month-to-month home loan repayments (depending an interest-only payment type of).

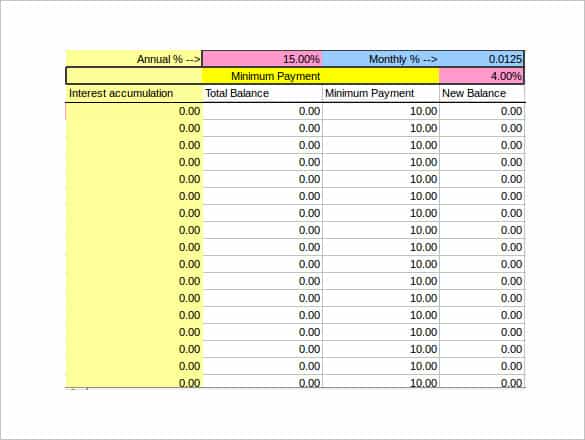

Exactly what mortgage hand calculators come?

While it’s a good idea to estimate your costs just before trying to get an excellent ?three hundred,000 mortgage, probably one of the most offending surprises could be a prospective loan rejection; understand that this type of calculators does not leave you an exact rates but merely a harsh estimate of what you will be eligible to have.

Have a look at almost every other homeloan payment instances:

- ?120,000 home loan repayments example

- ?150,000 mortgage repayments example

- ?180,000 mortgage repayments example

- ?2 hundred,000 home loan repayments example

- ?350,000 home loan repayments analogy

- ?eight hundred,000 home loan repayments example

- ?450,000 mortgage repayments example

- ?five-hundred,000 mortgage repayments example

Correspond with an expert concerning your ?3 hundred,000 financial criteria

A large financial company can help you find the best interest and make it better to get a ?300k home loan.

Although some lenders may well not give to particular consumers on account of tight requirements, it doesn’t mean those with unique items, particularly poor credit, should not be declined ?three hundred,000.

I work on brokers with the means to access numerous a whole lot more lenders when you look at the great britain. Capable assist you in finding lenders prone to take you up to speed.

By using away a great ?three hundred,000 mortgage getting three decades at a rate off step 3.92%, you then do pay ?step one,418 per month and ?510k full. A great 10-season term create charge a fee ?step 3,026 four weeks and cost ?363k altogether.