Jeff Gitlen, CEPF, ‘s the manager off development in the LendEDU. The guy graduated in the Alfred Lerner College or university out-of Business and Economics on College from Delaware.

Along with 2 hundred numerous years of feel, Citibank has already established time for you to cultivate a thriving economic company, and today, that have financing portfolio consisting of vast amounts of dollars, the business performs a serious character inside fulfilling the private monetary means off consumers throughout the world.

With such as a significant exposure throughout the banking and you can mastercard business, its likely that you have pick an effective Citi product in the some section, however with a lot of almost every other financing factors readily available, try a beneficial Citibank unsecured loan good for you?

Making an application for a great Citibank Consumer loan

Citibank brings three straight ways to own borrowers to try to get loans: on line, over the phone, otherwise on a neighbor hood part. If you are consumers are able to use those approaches to submit an application for financing to $31,000 , individuals who want to acquire increased loan amount need to incorporate of the mobile phone otherwise by going to their local branch.

Every online programs need to be completed by way of an authorized citibank membership, and you may individuals who do n’t have an online account need to sign in for 1 prior to finishing the net software.

Citibank unsecured loans come from $dos,000 in order to $50,000 ; yet not, qualification and also the software process count simply exactly how much you want to americash loans Fort Deposit use. Candidates that would want to acquire ranging from $2,000 and $a dozen,five hundred does very by using all app steps, like the Citibank web site. Concurrently, individuals who wish to sign up for money less than $a dozen,five-hundred aren’t required to has a good Citibank put account.

If, not, you should sign up for that loan for more than $a dozen,five-hundred, you really must have a great Citibank bank account that has been discover and financed for at least thirty day period.

Citi Unsecured loan Qualifications Conditions

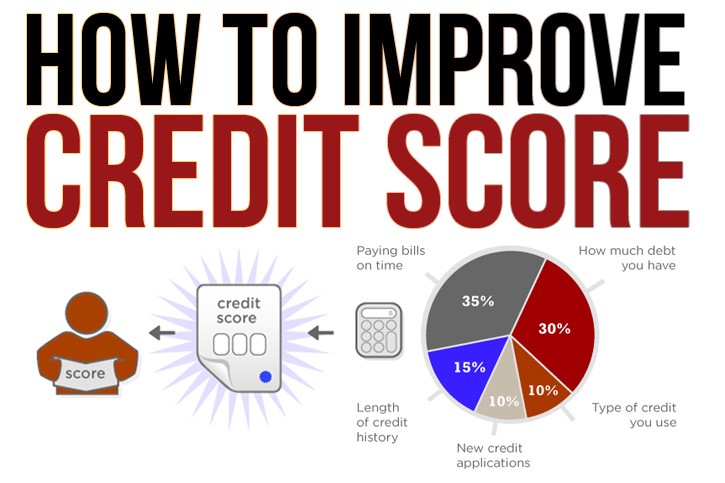

Is approved having an effective Citibank financing, you really need to have a yearly money of at least $ten,five-hundred . At exactly the same time, Citibank in addition to takes into account some other factors, like the questioned loan amount, your credit rating, as well as your personal debt-to-earnings ratio. While the financial doesn’t tell you particular criteria otherwise restrictions from these types of issues, most accepted people has actually a beneficial otherwise advanced credit.

If the recognized to possess a personal loan, financing should be obtained within you to definitely working day, depending on the time your loan is approved, just how you would want to located the funds as well as your proximity so you’re able to an effective Citibank part. Should you want to discover loans via send, or if you never live close a part, Citibank can usually overnight a.

In the event that acknowledged for an excellent Citibank personal bank loan, you could currently expect to found mortgage ranging from 7.99% and you can % , that have an installment identity all the way to 5 years . Interest rates depend on numerous factors, including your private credit score, the loan amount, and the financing name. With the some era, individuals may receive straight down prices if they’re Citibank people and you can if they choose a shorter cost identity.

Unlike certain lenders just who periodically add on multiple you to definitely-date or yearly fees, Citibank unsecured loans do not include application, origination, or yearly fees, and individuals aren’t punished getting early fees.

As well as a personal bank loan, Citibank offers some equivalent lending options, in the event they’re not thought repayment finance. Yet not, consumers may also want to consider another affairs.

Examining Including Line of credit

Readily available for up to $ten,000 , this new Checking Together with Credit line is made to give Citibank checking customers that have overdraft shelter, though it can also be used due to the fact a classic revolving line away from credit. To prevent users away from jumping monitors, so it personal line of credit will cover the fresh overdraft plus any fees to brand new acknowledged limitation.

Consumers are recharged a changeable annual percentage rate doing from the % , and attract is only placed on the quantity used – perhaps not the quantity of borrowing offered.

Personalized Credit line

The new Custom Credit line, which can range from $step one,five hundred in order to $25,000 , is made to help people that have major expenses, including renovations or wedding receptions, as well as debt consolidation services. Just as the Examining Including Personal line of credit, focus is only used on the current monthly balance, and you may individuals normally already predict varying costs ranging from % and you will % .

Great things about an effective Citibank Consumer loan

Having an instant on the web app techniques, applying for an effective Citibank personal loan is quite easy, and thanks to the application’s brief turn-around date, after accepted, loans (also the individuals delivered via mail) shall be gotten when the next business day and you may generally inside at the very least a couple of days.

At the same time, having a great $fifty,000 limitation amount borrowed getting existing Citibank consumers, particular consumers will see one an unsecured loan due to Citibank commonly grant all of them usage of extra money in comparison with personal bank loan facts supplied by other traditional loan providers.

Plus, and no origination, software, or annual costs, particular borrowers will discover one to pricing, though maybe not super aggressive, end up being inexpensive if the compared to the loan providers that do fees a variety of costs.

Disadvantages of a great Citibank Personal loan

Regardless of if primary candidates can discover lower prices into financing, in comparison with other lenders, Citibank does not always give you the best pricing.

Additionally, though some borrowers may well not look for a positive change during the pricing and you will words, one thing that is generally a great deal breaker are Citibank’s Better business bureau get, that’s already an F. Of many customers recommend that there is certainly a deep-rooted customer service issue you to leads to worst or inconsistent advice or problems and you may questions that go unaddressed, each other after and during the program processes.

Ultimately, if you are not a Citibank consumer and require to borrow a lot more than $several,five-hundred or need fund instantaneously, brand new thirty-time, funded membership criteria elizabeth is valid if you would prefer to have your money downloaded, an alternative which is restricted.

Bottom line

When you’re an existing Citibank consumer that have advanced level borrowing and also you you want that loan timely, Citi keeps possibly aggressive cost and can originate loans easily.

But not, prospective candidates is always to check around and you can evaluate an informed unsecured loans, as straight down rates would are present. Next, before committing to it financing, customers must also believe Citi’s regular poor buyers evaluations.