- Title search payment and you will identity insurance rates: This $700 so you’re able to $900 charges discusses the expense of searching brand new ideas and make yes you happen to be truly the resident, and insurance coverage for any problems within this processes.

- Recording fee: That it percentage out-of $forty to $100 will pay local governing bodies so you’re able to officially number the mortgage data.

How to All the way down Refinancing Will set you back

The menu of closing costs above may seem daunting, also it can be vision-beginning to see simply how much refinancing really can cost you. But when you find yourself refinancing your home loan isn’t really cheap, luckily for us you have got enough chances to reduce men and women fees.

Alter your Borrowing

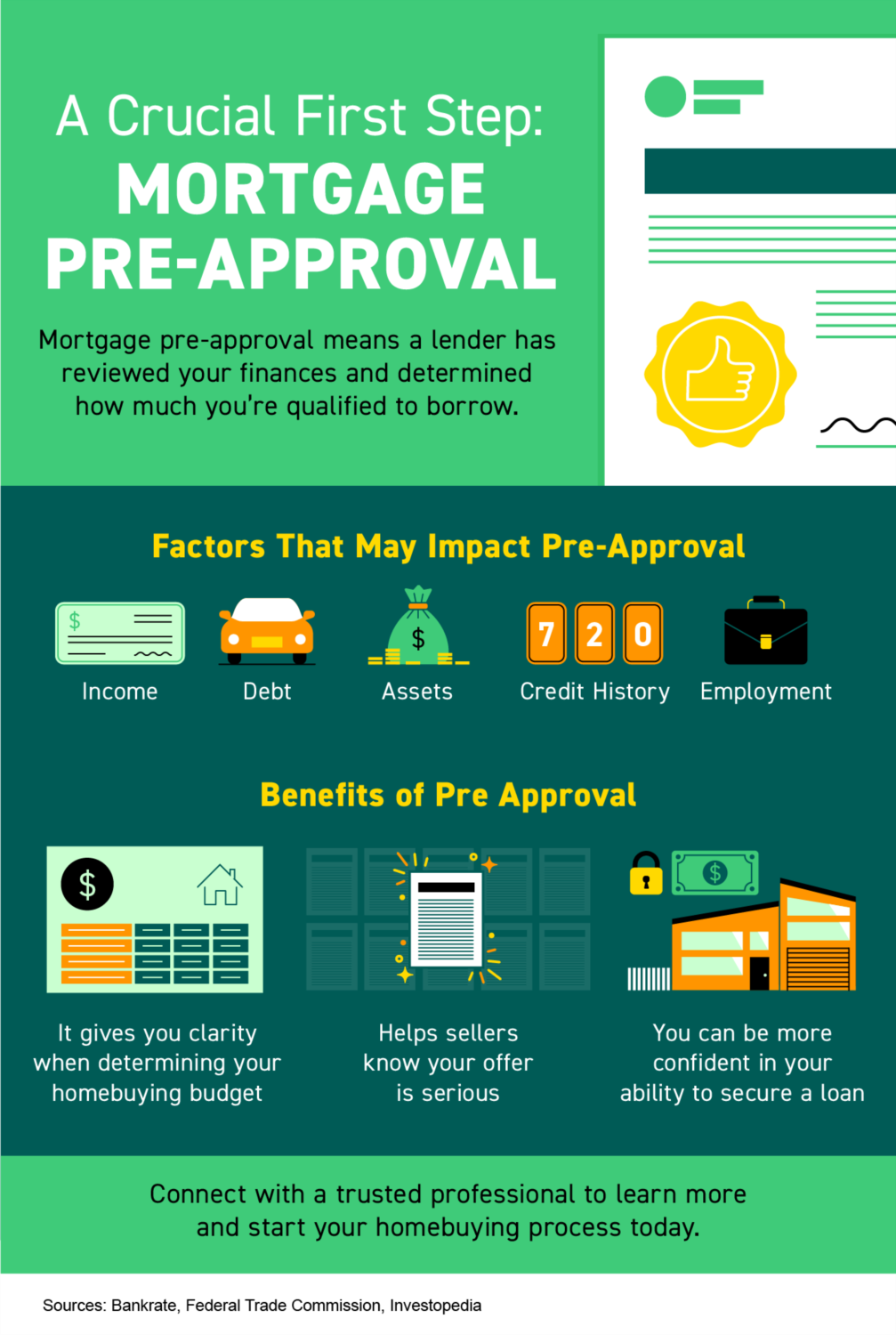

Having a much better credit score, you might be capable of getting a lower life expectancy interest rate, the most significant rates in taking right out home financing.

Improving your borrowing from the bank usually takes day, however, it is possible to get started today. All suggestions boils down to three basics:

- Constantly pay the costs timely.

- Pay down (and in the end get rid of) the credit card debt.

- Be mindful of your credit file.

Buy an informed Speed

That have a good credit score will allow you to get a better rate. But in the event you are still taking care of enhancing your get, certain lenders commonly still provide finest pricing than the others.

Is examining their rates with as numerous lenders as you possibly can. Rate-looking other sites are helpful, however, be sure to also get in touch with local credit unions so you can get the full range from possibilities for you.

Discuss The Settlement costs

Once you see a loan provider you adore, they have to provide you with an official mortgage imagine. Next webpage from the standardized file boasts a report on around three sorts of settlement costs:

- Lender costs (Area An effective)

- Features you simply can’t look for (Area B)

- Attributes you can go shopping for (Section C)

You can’t really do just about anything that have Point B, you could manage Area Good and you will Point C. Comment the lender-certain will set you back from inside the Section Good and try discussing along with your lender to reduce or waive some of the costs. This new worst they could do was state no, and you will be in the same position you are today.

To own Area C, you might be able to look around for various inspectors, appraisers, surveyors, and stuff like that. You will need to do that really works your self, and make contact with your own financial when you’ve discover a cheaper replacement for.

Discovering this new settlement costs when refinancing is a big adequate hindrance for most people one to some loan providers bring «no-closing-costs refinances.» You do not need to pay something upfront in such cases, payday loan Mcclave but you’ll nonetheless pay those can cost you in two chief suggests.

Very first, loan providers may charge a high interest rate in these financing, thus they’ll ultimately make straight back the bucks they’re not bringing on the start of the new financial. 2nd, loan providers you will encourage you to definitely move all settlement costs to your mortgage, definition you will have an amount big equilibrium to settle-and you might spend even more for the appeal.

Regardless of the method the financial uses, all sorts of things an equivalent: You’ll have a top monthly payment than just if you’d paid back the latest closing costs upfront, and thus, the loan tend to be high priced finally.

The bottom line

Although refinancing financing will cost you a great deal, you might however spend less in the long run if you rating a lower rate and you can/or re-finance to have a smaller identity. The only method to know what their refinanced mortgage might cost is always to work on this new numbers for your self using a mortgage refinance calculator.

Private mortgage insurance coverage (PMI): Even if you did not have individual financial insurance (PMI) in your fresh mortgage, it could be an integral part of the cost to refinance. Loan providers generally require PMI whenever a buyer provides lower than 20% available security from inside the home financing. The latest PMI covers the financial institution but if a borrower defaults towards a loan.

We could assist you in deciding whether or not refinancing is the proper disperse to you personally in today’s economic climate. We are able to make it easier to think about the expenses versus the benefits of refinancing and establish whether or not another type of financing you may best fit your debts and wants. Get in touch now.

- What is the FHOG?

Refinancing their financial is present an effective way to decrease your notice rates and mortgage repayment, otherwise cash-out family guarantee. Because you package ahead for example, you are thinking, How much does they prices so you can re-finance a home loan? Is a fast writeup on prospective will cost you and you can facts to consider.

Term payment: A name percentage try repaid to help you a subject business one to reports property deeds and guarantees no-one otherwise provides a state with the property you are refinancing. This might be also known as a subject search.

- Survey commission: This $150 in order to $eight hundred fees ensures their belongings together with structures involved have suitable spots.