For many who incorporate within our Application or on the internet and it is also accepted on the web, your loan could be directed to your earliest direct very first Account quickly, so you’re able to place your agreements towards step straight away. We’re going to post a loan agreement form about how to sign and post to all of us. Whenever we discovered it closed mode, we are going to transfer the bucks into your 1st Account.

Could there be anything that I am unable to explore my loan to possess?

You can make use of the loan for many some thing – should you choose build a robot dog, we had like to find it.

- purchasing possessions you can try this out otherwise end up in or outside the United kingdom – in addition to getaway belongings and you can leases

- to purchase a combined share inside a home

- to acquire aside a joint owner

- a home loan deposit (no matter what lender otherwise country)

- gifting funds to help with the acquisition of a house, including home loan places, stamp responsibility and you will solicitors’ fees

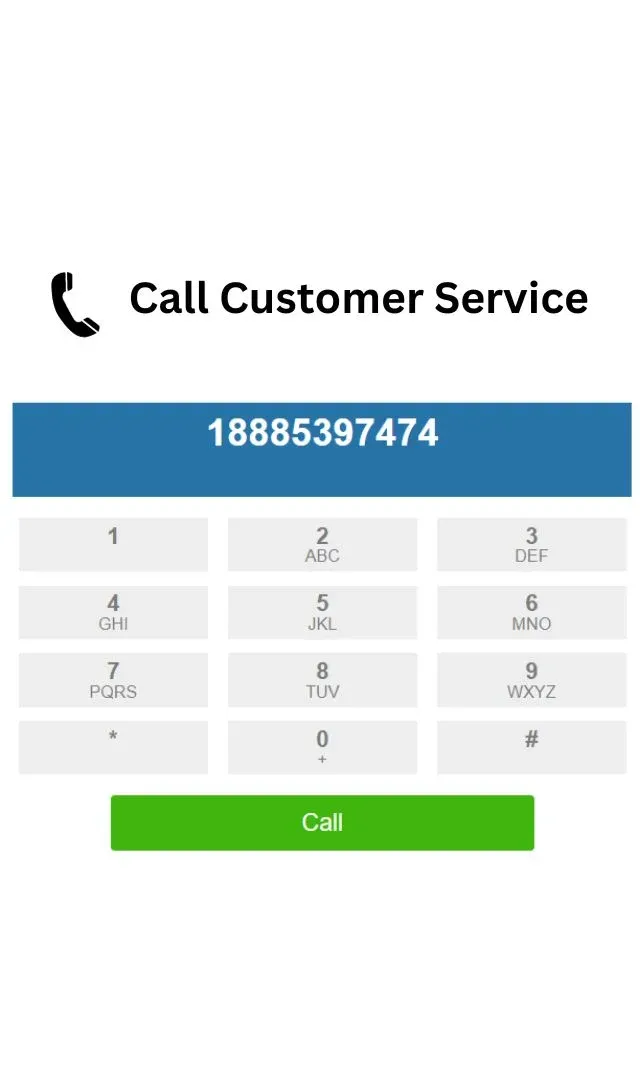

A personal loan really should not be having betting, team purposes or sharedealing possibly. So it number actually personal you could call us if you need clarification towards 03 456 100 199** away from so you’re able to , all week long.

Can i explore my personal financing so you can consolidate loans?

Sure, for as long as it is court rather than to have team fool around with. But if you’re using some otherwise all of the money so you can pay off, clean out otherwise combine most other borrowing from the bank, a few it is effectively for you before going to come.

Exactly how is the desire computed?

At the start of the financing, we calculate the quantity of desire payable (total cost away from borrowing from the bank) and you may spread it out across the financing name. We determine the interest owed off for every single month-to-month cost based on what amount of weeks between repayments and the a good financing balance. It means i assemble increased ratio of your overall attract in the beginning of the mortgage, in the event that funding harmony was bigger, and a lower life expectancy number towards the end.

In the event that you can find delays anywhere between costs, then a great deal more desire often accrue through that several months. For example, this may happens in case the commission date you choose is more than simply 30 days following go out your sign their agreement, or you simply take a fees holiday that isn’t found when you look at the your own credit agreement. While we can’t ever costs way more complete interest than found to your the borrowing from the bank arrangement, this may imply that this new rebate you get for paying down your loan very early is lower, or may go right down to zero.

Can i repay the borrowed funds early?

Without a doubt. You can repay the loan completely anytime by the providing us with observe – sometimes of the calling united states towards 03 456 100 199**, sending an email regarding the Cellular Banking App otherwise Online Banking, or in writing. We’ll leave you money profile, so when enough time because you shell out that it completely, we can romantic the loan account. If you decide to repay the loan very early, there may be a reduction in the level of appeal your need to pay, and it will be mirrored on your own payment figure.

Are there costs for repaying early?

Yes, getting fund that have a good 12 day name, we will become a fee from twenty-eight days’ interest as an ingredient of one’s last settlement shape.

To own fund with a term away from 13 – 96 months you’ll encounter an additional step 1 month’s charges, and additionally 28 weeks interest, in your finally settlement figure.

You may then has 28 weeks to pay that it. Next twenty-eight day several months you will need to ask all of us to own an alternate shape while the amount vary.