A property security mortgage normally open the new financial potential having property owners. Of the tapping into the worth of your house, you can access fund having renovations, debt consolidation reduction, otherwise biggest expenses, all of the when you’re enjoying the aggressive rates in the official.

This article will explore the latest particulars of home guarantee loans for the Minnesota, plus how they performs, the benefits they give, therefore the secret standards you really need to meet. Regardless if you are provided a traditional house equity loan (HELOAN) otherwise a flexible family collateral credit line (HELOC), you’ll learn how exactly to navigate the options and you will optimize your home’s possible.

A home collateral mortgage enables you to borrow secured on the brand new security in your home, the difference in the house’s well worth and you can any an excellent home loan equilibrium. It mortgage brings a lump sum of cash you will need to pay-off more than a fixed identity which have set monthly obligations, it is therefore simple to package your financial budget.

If you’re curious how a home guarantee mortgage work, consider it while the the second home loan. The quantity you could potentially borrow relies on the residence’s security, credit score, and you can money. Generally, lenders need you to take care of no less than 10-20% guarantee in your home adopting the financing.

To apply for a house security mortgage, you will need to assemble various economic records, also paystubs, W-2s, and you will tax statements. Whenever you are thinking-working or have ranged earnings, think about the lender declaration HELOAN. That it house equity financing enables you to be considered playing with 1-2 years out-of lender comments, simplifying the process and giving alot more liberty.

Think about, utilizing your house given that collateral setting you chance foreclosure for those who are not able to create payments. Therefore, it is important to consider carefully your financial situation and future preparations prior to investing in a house collateral loan during the Minnesota.

Types of Domestic Collateral Fund

There’s two particular house security funds into the Minnesota: the standard household collateral financing as well as the family equity collection of borrowing from the bank (HELOC).

A property guarantee financing now offers a lump sum of money which have a predetermined rate of interest and you can monthly payments. These financing is perfect for high expenses like domestic renovations otherwise debt consolidation reduction. House collateral financing cost inside the Minnesota can vary, making it best if you evaluate even offers.

Additionally, a property security line of credit (HELOC) properties similar to credit cards. You could use as required, as much as an appartment limitation, and just spend notice on what you use. HELOCs typically have adjustable costs, that will be advantageous if the prices is actually low but may increase over time.

When considering a HELOC vs. a house security financing, think about your economic requires and you may payment needs. Minnesota family collateral finance give balances, if you are HELOCs render independency. It is important to purchase the alternative one to best suits debt state and you can desires.

Pros and cons off Minnesota Home Collateral Loans

House equity loans when you look at the Minnesota might be a terrific way to accessibility money, however it is vital that you weighing the advantages and you may cons:

Pros out-of home equity money:

- Fixed rates of interest: Of many Minnesota household collateral loans offer secure prices, and also make cost management easier.

- Lump sum: Obtain the whole loan amount upfront, that’s ideal for highest costs.

- Possible taxation gurus: Notice is tax-deductible in the event the employed for renovations.

- Short monthly installments: As compared to higher-focus handmade cards otherwise signature loans, the new payment per month for the a house guarantee loan are going to be apparently lowest.

- Maintain first-mortgage: You have access to their house’s collateral while keeping your existing reasonable-rates first mortgage undamaged.

Drawbacks out of household equity financing:

- Threat of foreclosure: Your home is guarantee, thus overlooked money can lead to property foreclosure.

- Obligations improve: You’re incorporating a great deal more personal debt for the current mortgage, which will be high-risk if home prices drop-off.

- Highest interest rates: Home security financing costs inside the Minnesota usually are greater than those individuals for a primary antique financial.

Just how to Qualify for a property Security Mortgage from inside the Minnesota

Qualifying to possess property security financing into the Minnesota concerns meeting trick requirements. Wisdom these could make it easier to get ready while increasing your chances of acceptance. This is what your generally must qualify:

- Loan-to-really worth (LTV) ratio: New LTV ratio was calculated by the breaking up extent you borrowed by your home’s appraised really worth. Including, when your mortgage harmony try $120,000 plus residence is appraised on $160,000, their LTV proportion might be 75%. Lenders typically favor an enthusiastic LTV ratio out of 80% or straight down to reduce risk.

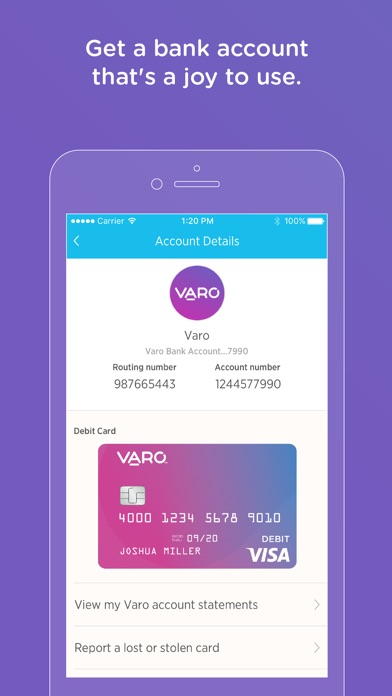

To have an easier app processes, contemplate using new Griffin Gold application. It helps you which have loan places Scottsboro cost management and you may capital, making it easier to deal with your financial situation in the software procedure.

Sign up for a house Equity Financing when you look at the Minnesota

Trying to get a home equity mortgage from inside the Minnesota would be good smart financial disperse, regardless if you are looking to financing renovations, consolidate financial obligation, or availableness more money. From the experiencing their home’s collateral, you could safe a loan with competitive rates. To begin with, make sure you meet up with the trick standards, such as for instance which have enough family guarantee, a good credit score, and you will a manageable debt-to-earnings ratio.

To try to get a house guarantee financing within the Minnesota, consider utilizing Griffin Resource. Griffin Money often make suggestions from application process, working out for you optimize your domestic collateral. Do the first rung on the ladder right now to discover the home’s economic potential.