Relationship Home mortgage is a residential mortgage company located in Kansas. Functioning from inside the 48 states and Area out-of Columbia, the firm now offers many mortgage items. They’ve been repaired-rate and varying-rate mortgage loans, in addition to FHA, Va, USDA, refinancing, rehab, and you can the framework funds.

Without yet , a national mortgage company, Relationship Mortgage loan really does operate in forty-two claims. It is registered to conduct business throughout claims except Their state and New york.

What kind of Financial Ought i Score with Relationship Home loan?

Fixed-rate mortgage loans: Probably one of the most preferred sorts of mortgages, a fixed-speed mortgage keeps a-flat rate of interest on the longevity of the mortgage. Mortgage conditions on Partnership Home mortgage can vary off ten so you can thirty years.

Adjustable-rate mortgages: Referred to as Case funds, adjustable-speed mortgages start off with a predetermined rates in advance of becoming familiar with industry prices after an appartment several months.

FHA money: Covered because of the Federal Houses Administration, these special mortgages need a minimum step 3% down payment and will become more available to borrowers having early in the day borrowing from the bank activities.

Virtual assistant loans: Supported by the fresh Institution off Experienced Issues (VA), these loans are made to help certified military advantages, pros, and you can reservists purchase residential property. Whether or not consumers must pay an effective Va capital fee, normally banking companies none of them a down-payment for it type regarding mortgage and may also promote a lesser interest than with a conventional loan product.

USDA financing: Offered just from inside the appointed outlying section, brand new Company regarding Agriculture (USDA) brings this type of finance to maintain and you may refresh alot more rural components of the country. Unique terms and conditions may be offered, eg 100% money and higher independency having borrowers with straight down or poorer credit scores.

Exactly what do You are doing On the web which have Commitment Home mortgage?

Commitment Mortgage offers easy mortgage and refinancing calculators to assist you imagine your monthly obligations before applying. The net hand calculators can also help you break apart the borrowed funds costs for simple wisdom, together with demonstrated how much cash you could potentially cut having a great refinanced financial from the a lower life expectancy interest.

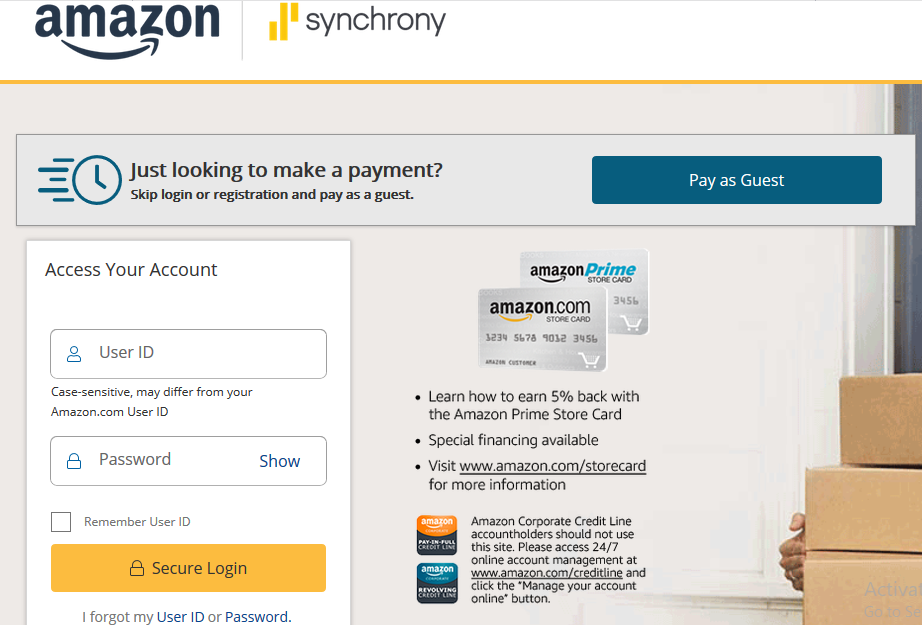

You simply can’t implement privately to have a home loan on line having Relationship Domestic Home loan, even though you can also be control your loan using their customers portal. Questions on line is simple and easy, but you need to complete a questionnaire otherwise name in person to talk to financing administrator to help you implement.

But not, you can sign up for financing through the My personal UHM software. Prospective browse around here borrowers is also upload all documents required to the fresh new application, tune its applications, and estimate money using their mobile phones. In the event of one affairs, the firm provides a phone number and email address for additional assist.

Might you Qualify for home financing Off Connection Real estate loan?

:max_bytes(150000):strip_icc()/ratioanalysis-Final-6b8f05a58b3e4a8b9055000cb874305d.jpg)

Like any most other mortgage lender, Commitment Home mortgage you should never deny a casing financing only due to a great borrower’s credit history. Extremely lenders, however, would ask for an excellent FICO rating with a minimum of 620 getting a traditional financing, while you are specific bodies-supported programs allow for consumers having less-than-reasonable credit. Other factors you to loan providers thought is your debt-to-money proportion as well as the cost of the need household.

Of many bodies-supported mortgage loans will even need to have the borrower to pay a private mortgage superior (PMI), as commonly old-fashioned fund with off repayments away from less than 20%. With respect to the financing unit, particular certified buyers may not need certainly to lay any cash off anyway.

What is the Processes for finding home financing That have Union Home loan?

You can either initiate the process by the doing the new contact form on the internet otherwise through the use of myself from the My personal UHM app. Filling out the program usually show you courtesy an evaluation away from mortgage possibilities plus the requirements had a need to disperse the application send. With respect to the Connection Home web site, you can aquire prequalified in minutes.

An expert often appraise your property as soon as your app could have been obtained along with your render has been approved. When your financing could have been processed and you may completely recognized, it would be underwritten as well as your closing would-be booked.

Exactly how Commitment Mortgage Gets up

Though Partnership Real estate loan even offers some mortgage selection, they don’t really operate in all condition. Very many borrowers will most likely discover something that really works better due to their points, certain potential customers only don’t have you to choice.

On top of that, the business has a very easy-to-use cellular app, that may appeal to customers who enjoy utilizing their cellular phone so you can create the cash. To own people who favor a old-fashioned, face-to-deal with interaction, Partnership Home likewise has branches across the country with financing officers available through the practical regular business hours.