The decision to file for bankruptcy try a difficult one. However it is will important for people up against challenging obligations, providing them with a spin on a financial start. Personal bankruptcy have outcomes affecting your finances.

To find out more on how personal bankruptcy could affect debt upcoming, ideas on how to reconstruct your borrowing immediately after filing for bankruptcy, and exactly how a personal bankruptcy lawyer can help, get in touch with Sasser Law firm today to own a free of charge session.

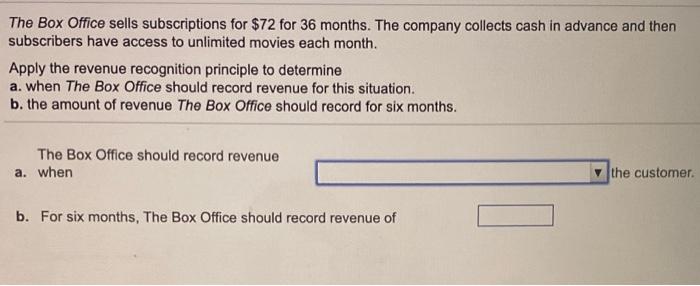

Filing for personal bankruptcy may have wider-starting consequences on the monetary upcoming, the fresh information on which confidence and that section you document below. Both most typical types of bankruptcies is actually:

- Chapter 7 bankruptcy proceeding – During the chapter 7 there’s prospect of the loss of low-exempt assets to make sure that continues enforce to spend creditors. In most chapter 7 cases the fresh new borrower may be able to excused each of their property and as such very a bankruptcy proceeding times is actually no-asset times. A chapter 7 is on your credit score having a decade. Generally a borrower can obtain playing cards and automobile financing in the near future just after bankruptcy proceeding albeit towards faster advantageous words than just some body having an effective borrowing. A borrower normally must hold off 24 months out-of release in order to qualify for a normal loan without any help of good co-borrower that have a good credit score.

- Section thirteen bankruptcy – Labeled as reorganization case of bankruptcy, Part 13 relates to restructuring the money you owe and doing a plan to pay them away from more than a specific period of time as opposed to offering any of your assets. A chapter thirteen filing is also remain on your credit report to own doing seven years. As with a bankruptcy proceeding, following filing of an incident, the latest debtor’s capacity to access quality borrowing from the bank is generally restricted having the original few years into problem gradually improving while the the fresh new borrower spends credit and you can fast will pay on the their or this lady accounts.

Whichever sorts of you select, brand new cousin impact on creditworthiness might possibly be a purpose of how an excellent the credit score try prior to the personal bankruptcy. In case the credit score is terrible then your perception will feel minimal. And, coming creditworthiness may be from little transfer for some as well as significant import so you’re able to anyone else.

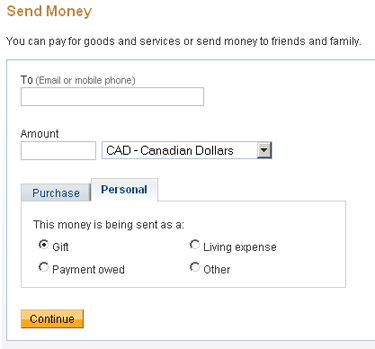

Obtaining Money Once Case of bankruptcy

It is essential to consider when applying for financing immediately following bankruptcy would be the fact your credit score tends to be different than in advance of. You will likely be able to find loan providers who will be happy to work with you. However, some times, a collector will charge large rates and you can/or want huge off payments.

It is very important remember that bankruptcy will remain in your borrowing from the bank report to own seven in order to 10 years. Try to work on rebuilding the credit during this go out by making normal costs timely and you can keepin constantly your stability lowest. You will want to provides dos-5 individual notes that you use and come up with punctual costs toward so you can rebuild your credit score having. It is a good idea to become old-fashioned and you can responsible having your charge card utilize.

Another important factor to look at when applying for financing after personal bankruptcy is the sorts of loan you are applying for. Really loan providers will reveal to you brief handmade cards, secured finance, or any other sorts of smaller fund to people having dinged credit. If you are looking having a mortgage loan, you might have to wait until your credit rating possess enhanced.

Restructuring The method that you Strategy Your money After Bankruptcy proceeding

Loans difficulties can seem to be challenging. We hope, bankruptcy proceeding enables you significantly more design and you will reassurance regarding the financial obligation (e.g., lease, utilities, food, clothes, insurance coverage, etc) and leftover expenses (e.grams. domestic mortgage, car loan, student loan, etc.)

An improvement from inside the reorganizing your bank account shortly after case of bankruptcy was creating a budget so you’re able to monitor your own expenditures and you can remember to is paying what you are able manage. Make sure to tend to be coupons needs on the budget to ensure you can start increase the discounts profile and you will making certain economic coverage.

You may need certainly to opinion your credit score and you may consider delivering a number of credit credit/financing. This will help you rebuild their borrowing from the bank and have loan providers that you are responsible and equipped to handle loans. That have in charge economic government, you could reconstruct your own borrowing from the bank over time.

Just how do an attorney Let?

A skilled bankruptcy proceeding lawyer helps you elitecashadvance.com short term installment loans comprehend the outcomes away from filing for bankruptcy proceeding, decide which chapter is best suited for your needs, which help you browse the fresh new papers and court process associated with the the procedure. Within Sasser Law firm, we understand you to definitely considering bankruptcy would be tiring. Our company is serious about bringing top quality courtroom image and enabling our very own customers result in the top choices for their monetary futures. The lawyer will show you the consequences of declaring bankruptcy proceeding and you can aid you to understand more about solutions to your advantage. We shall address any queries you may have concerning the court conditions away from declaring personal bankruptcy, such skills credit scores, developing a fees plan, and dealing which have financial institutions.

On Sasser Firm, we’re happy with our very own over twenty years of experience and you may the 10,100 some body and small enterprises you will find helped as a consequence of bankruptcies and most other financial hardships. E mail us now to have a no cost appointment for more information on how exactly we can help and you will just what alternatives is generally available to your.

- In regards to the Journalist

- Most recent Posts

For over 2 decades, this new Sasser Firm might have been providing someone and you can advertisers examine financial hardships to see the fresh new light which shines at the end of one’s tunnel. The North carolina bankruptcy lawyer are common panel-certified gurus, which means i have introduced a complex test, gone through an intensive peer comment, and always earn legal education loans within this actually ever-evolving area of legislation.