After you opinion this new statement, pick new Reissue ID/Report ID you will have to submit to LPA

Step two: Display brand new Confirmation regarding Assets Strategy to Debtor Start a verification from property because of the connecting the new subscription process to your own borrower(s) and you can get together preliminary advice for the demand.

Crucial! For this reason, obtain the following recommendations per borrower who’s taking property on mortgage: ? The initial and you can history name of any debtor ? Home address ? The email target the new debtor might possibly be using ? Mobile phone number (when the offered) ? Big date from Delivery (DOB) ? Personal cover number (SSN) *Exception: When the a merchant account was shared, singular of members has to sign up/fill out the brand new economic membership.

? Who will found an email: For each debtor delivering assets with the loan Email Invitation software will found a subscription current email address with brand new Website link with the subscription webpage. ? Where email address might possibly be sent to: The e-mail registration invite might possibly be taken to the email address the fresh new borrower provided. ? Where in fact the email address might be sent Regarding: New From industry will teach, instance, [emailprotected]_Provider additionally the email address gives suggestions to access the service provider’s subscription site. ? When to predict new subscription invite: Promote an extent to own in the event that borrower can get to get the email invite and you will what direction to go once they dont located they. ? Email address reminders: The financial institution normally begin go after-up emails on debtor, if required. ? Timeframe brand new Hyperlink is valid: Such as, in case the Website link link was active getting three days, let the borrower know that after 3 days, the order was immediately signed; the order is cancelled because of the requestor ahead of one big date. Financial Account ? Borrowers have to have the next information on hands just before entering Information information regarding financial institutions: – Name(s) of each and every standard bank (know the website target used to get on the lending company just like the specific lender labels was equivalent). – The associated login history.

? The amount of property that have to be verified to help the newest borrower figure out which account to include in the verification process. ? When including financial username and passwords: – The brand new debtor can pick which financial institution(s) and you can associated account(s) to express, along with in the event the there are multiple account at the same facilities. – Since debtor indicates he or she is complete, a research is generated. When your debtor returns to your techniques once again later on and you will implies he/this woman is done once more, another type of statement will be written. If the debtor abandons the procedure in place of proving the guy/this woman is finished, no report is established, therefore the borrower is also go back to finish later on.

Step 3: Request the newest Verification out-of Possessions To help you request new confirmation away from assets, complete your order just like the indicated on steps lower than.

dos. Get into called for information, along with at a minimum, the newest borrower’s basic and history term, home address, contact number, current email address, SSN and you will day out-of delivery.

You must complete a confirmation regarding property request for For each borrower who will be taking possessions compliment of Mortgage Tool Advisor’s automated advantage research so you can qualify for the borrowed funds*

The new borrower need subscribe their unique profile by using the services provider’s system. Consider brand new appendices to possess take to borrower tribal payday loans subscription methods.

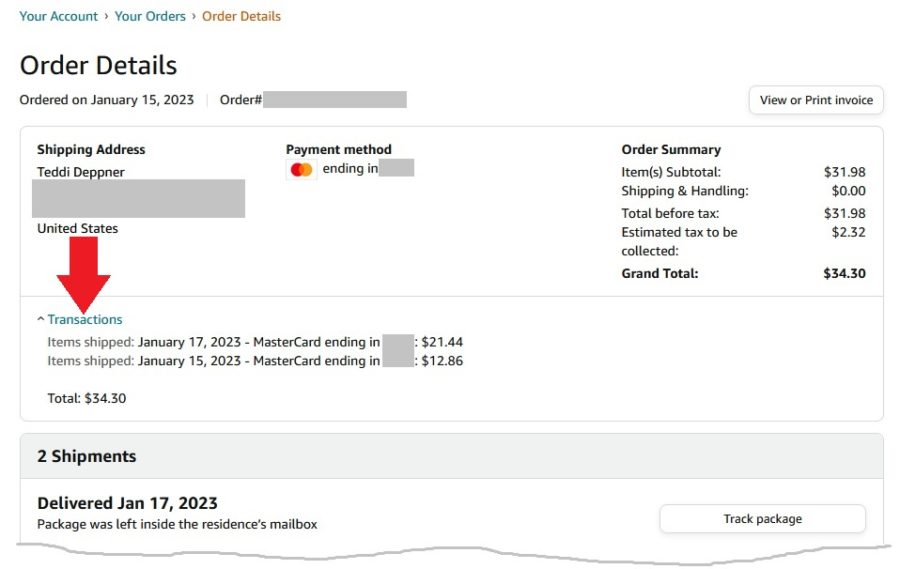

The service provider’s program immediately yields the fresh new house confirmation declaration immediately following borrower registration is finished. The fresh declaration includes investigation and respective exchange records with the monetary institutions and membership provided by the brand new debtor. Most of the advantage verifications profile need to be old only about 120 weeks before the Notice Time, or Active Time from Permanent Resource for Design Conversion and you may Renovation Mortgage loans.