Now that you’ve got reviewed a guide to domestic security funds and mortgage loans, why don’t we dive even higher and you may talk about the trick differences when considering these one or two common loan choice:

Huge difference #1: Spends

Possibly the biggest difference between a home guarantee mortgage and a great home mortgage comes down to the usage of the mortgage. An interest rate is employed in order to 1st pick a property or refinance a property. As well, a property equity mortgage is utilized once you’ve bought good the home of shelter the cost of do-it-yourself home improvements, performing a business, time for school, etc.

Distinction #2: Qualifications

Various other difference in a house security financing and you may a mortgage means qualification. While one another family equity funds and you may mortgage loans envision facts including credit score, money, and you may debt-to-money ratio (DTI) when choosing qualification, house security fund also require which you have at the https://paydayloancolorado.net/ovid/ least 20% equity on your existing the place to find be considered.

Improvement #3: This new Loan’s Rates of interest

Household security loans and mortgages come with assorted focus prices. Even if domestic equity finance generally come with straight down costs versus other sorts of unsecured loans, this type of interest rates remain always more than those that come with mortgages.

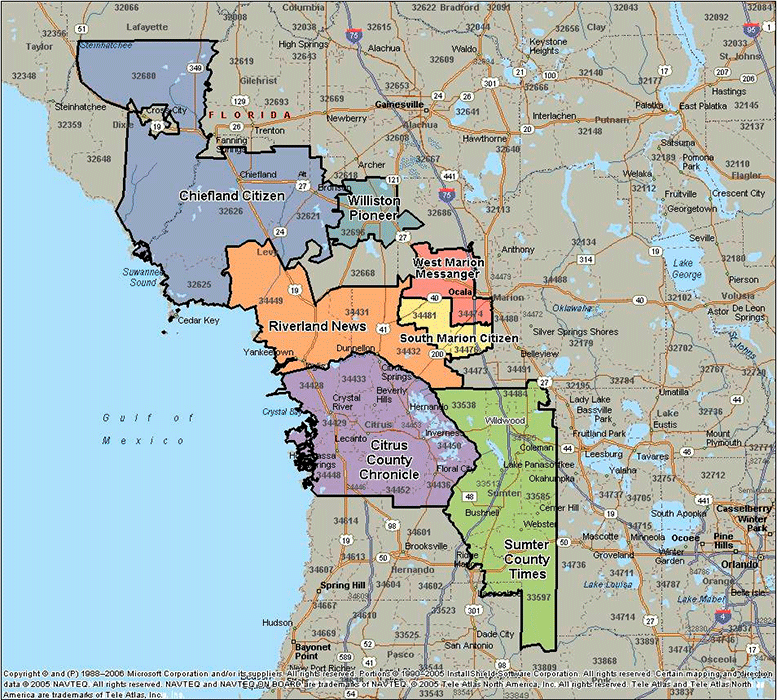

Meanwhile, understand that interest levels are different for everybody mortgage items predicated on your credit score, venue, financing title, or any other factors.

Change #4: Mortgage Terms

The loan identity is another difference between household security funds and you can mortgage loans. Very mortgages, such as for example antique money, incorporate extended terms of 3 decades, although 15-season conditions are also available.

Instead, house collateral funds come with quicker conditions which can range from five and you will 15 years. It mortgage variety of always boasts highest rates.

Huge difference #5: Taxation Write-offs

Its important to imagine differences in income tax deductions between house security financing and you may mortgages. For people who grabbed your mortgage in advance of , you’re able to subtract the eye on the loan amount up so you can $one million. For many who got your mortgage loan just after , you’re able to deduct the interest in your financing as much as $750,100.

If you’re using a home collateral loan so you can pick, build, otherwise considerably boost the household one protects the borrowed funds, it’s possible to subtract the interest on your own mortgage as much as $750,000. Before, you used to be capable deduct the interest on the loan no number how the money was used. Brand new laws relates to family guarantee fund away from 2018 to 2025.

Which are the Benefits and drawbacks away from a property Security Mortgage?

- Freedom to make use of the funds as you would like to further the monetary wants particularly to find a residential property, renovating your house to build guarantee, otherwise carrying out your own company.

- Fixed interest levels translate into fixed costs and versatile words one to range between four so you’re able to 15 years.

- Apparently lower rates of interest compared to other kinds of financing one might generally speaking used to fund investment, training, organizations, etc.

- You reside put since the guarantee for your house security mortgage, so you will be placing your residence on the line if you aren’t able while making your loan payments.

- You’ll be that have generally several mortgage payments because the home security funds are also also known as 2nd mortgages.

- You are going to spend even more from inside the attention with a home security financing as compared to property security line of credit given that you happen to be borrowing from the bank a lump sum.

Which are the Positives and negatives of an interest rate?

- Helps you first secure a house, and next upcoming generate security and eventually bring in a return or make use of your equity to many other aim.