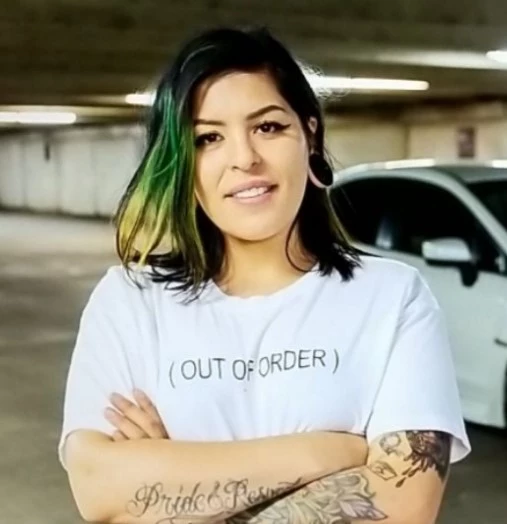

Exotic Smith out-of Yes, I’m Low priced delivered this matter to the attract when she demonstrated you with an issue thru Myspace:

Under-served, actually. Immediately after a bit of research towards the a few loan providers and you may a visit to an excellent Coldwell Banker’s financial representative (just who guaranteed an agent manage follow through with me contained in this 24 period, but don’t performed), I was leftover without any clear solutions, but far more computed than ever before to locate them.

Which Requires For example Short Home loans Anyway?

It was my personal very first thought. Purchasing the majority of my entire life when you look at the expansive, densely-populated and you will exorbitant construction ely, new Southern Bay’s Coastline Locations – I have a tendency to skip one 1 / 2 of-billion dollar house are not the norm throughout all country. According to Trulia, the newest median well worth to have a single-house in La, California today is $301,146.

Home owners surviving in small places otherwise disheartened regional economic climates, where assets thinking are quite lowest, don’t have to borrow hundreds of thousands of dollars to acquire possessions – they merely you would like around some body looking to buy a good higher-end the latest auto.

You will also have men and women residents that has protected their funds 15 or twenty five years before, have paid back most of the prominent harmony to their mortgages, but really want to benefit from the current unbelievable financial cost by the refinancing bad credit loans in Yampa CO.

Unfortuitously, if we should obtain otherwise refinance a mortgage out-of only $50,one hundred thousand or shorter, couples loan providers are able to accept they.

As to the reasons Lenders Don’t like Delivering Small Mortgage loans

So why is it so hard to find a loan provider providing small mortgages not as much as $50,100000 before everything else? Generally, it isn’t worth it with the lender (and/or debtor, oftentimes).

That’s because in the event the financial is for $50k otherwise $500k, financing origination and you may repair prices are about the same. A loan of numerous hundred or so thousand cash more than couple of age has the lender a pleasant make the most of interest, while a much smaller financing demanding the same amount of money and effort to pay for they production significantly less. Usually, it is really not prices-active for a lender to provide particularly a tiny home loan.

In the event that loan providers lose money bringing very brief lenders, they aren’t gonna go out of their way to advertise its availability, way less the higher rates with the such money. That does not mean, not, that we now have zero loan providers available to choose from who can provide that.

Getting a small Home loan and you will Alternatives for Whenever You cannot

Because this type of short lenders is actually strange doesn’t invariably suggest they won’t occur. If you would like money for a home that doesn’t rates extremely much, you might be capable of getting they if you’re ready to make the works.

Contact Local Banking companies and you will Borrowing from the bank Unions

Cannot be prepared to walk into good BofA or Pursue financial place of work and become accepted to have a beneficial $50k home loan. To get short lenders, you have to check out short institutions.

The first end are going to be the local lender; a current experience of a residential area lender or registration which have a good borrowing union is a fantastic in to settling a small house financing. Loan providers are a lot more prepared to work with people who prove the respect and duty which have currency.

Otherwise financial that have a community place, yet not, or you create, however they are rejected for a financial loan, you ought to continue to talk with agents out of local finance companies and you may CUs in your area and also her or him remark the money you owe (just don’t let them all run the borrowing from the bank!) to find out if a small home mortgage is actually a possibility. Remember, it may take a little while prior to searching for a lender who’s happy to aid you.

How to handle it Whenever Nobody Gives you a little Home loan

If you have tried calling regional lenders without any fortune, it’s time to select choice means of resource your property buy.

Instead of obtaining a mortgage, you might instead loans your residence purchase using a consumer loan. There are many different form of signature loans, anywhere between secured finance from biggest banking companies, so you can risky, very high-attract payday loan. Without a doubt, when you decide for the a personal bank loan, it’s important the conditions is in balance together with interest rate try affordable.

An alternative choice is always to acquire the money regarding a single willing to help you lend it-of-pocket in exchange for focus away from you. Discover a few fellow-to-fellow lending web sites one helps this type of transactions and you will are apt to have confident user reviews: Do well and you will LendingClub.

P2P lending websites such as are useful because users (both buyers and you can individuals) try pre-processed, given that interest rates energized are more competitive than personal bank loan rates within old-fashioned financial institutions. These two sites act as the latest middlemen, coordinating traders having borrowers exactly who satisfy official certification, plus a credit score assessment. Like most other loan, the pace billed to have a personal bank loan will depend on things like your credit history, amount borrowed and you can loan label. You should remember that the most amount borrowed invited of the Excel was $25,100000, when you’re Lending Bar funds money up to $thirty five,000.

Why you should Think twice On the Brief Mortgage brokers

Note that should you choose have the ability to fund a home having a mortgage loan out-of less than $50k, the rate might feel high to compensate getting the money the lender was dropping toward price. As well, if you’re settlement costs away from, say, $5,one hundred thousand would be felt perfectly practical towards a standard home loan, you to definitely stands for 10 % of good $50,one hundred thousand financing – not too realistic any longer.

Thus during the solution to Sandy’s issue, the banks and pricing readily available for mortgage loans under $50k vary by candidate, while won’t see them stated. Some loan providers downright dont promote these types of quick mortgage loans, when you find yourself individuals who will do the like an incident-by-circumstances basis.

I might indicates people trying a mortgage which small to get rid of for a moment and extremely consider whether it’s worth every penny – it might create one securing an interest rate for this nothing does not seem sensible economically. If you want that loan for less than $50k, imagine seeking another type of way to obtain resource, ily member otherwise friend, or just prepared on your own pick in order to cut back the bucks would certainly be spending on mortgage payments and you may spend bucks rather.