> 5. You shouldn’t be surprised of the high interest levels. While some earliest-time homebuyer software provide low- if any-appeal guidelines, not all create. Be equipped for the potential for highest interest rates to make sure the new percentage is actually your budget.

Kentucky earliest-big date homebuyer program conditions

Before you apply for all the program otherwise completing a homebuyer counseling system within the Kentucky, definitely meet up with the first-day homebuyer system standards so you aren’t throwing away your time.

Stuff you Should be aware of

Whenever examining to find out if your revenue drops when you look at the income restrictions to own a first-big date homebuyer system, you must know the median income constraints getting where in actuality the home is discovered. To obtain the latest Kentucky money limitations, enter a state and county information regarding brand new HUD website.

Federal earliest-big date homebuyer software

The new Kentucky first-big date homebuyer applications mentioned above is contingent towards recognition to possess a good home loan off a qualified financial. Truth be told there are mortgage applications, sometimes known as national first-time homebuyer software, that could make it easier to find the domestic you want. Such loans, even when, commonly usually just find for earliest-date homebuyers.

You can utilize assistance from a beneficial Kentucky first-go out homebuyer system to simply help cover the down payment and/or closing costs for example of them fund.

> Old-fashioned loans. Also called conventional mortgages, traditional mortgage loans routinely have more strict qualification criteria and higher financing limits than simply authorities-recognized mortgages. One or two well-identified applications that provide antique finance is actually Federal national mortgage association HomeReady and you will Freddie Mac computer Domestic You can.

> FHA fund. Backed by this new Federal Property Administration (FHA), such finance wanted reduce money minimizing credit ratings than just antique mortgages, while they together with normally have lower financing limits. At the same time, with an FHA mortgage, you are going to need to shell out home financing cost to safeguard this new lender for those who standard.

> Virtual assistant loans. Supported by the newest You.S. Institution from Pros Issues (VA) for effective and you can former people in the new army, an effective Virtual assistant mortgage doesn’t require a deposit or mortgage insurance coverage advanced. As well, lenders cannot cost you over 1% to summarize can cost you, but you will have to pay an excellent Virtual assistant investment commission between 0.5% and you may step 3.6%.

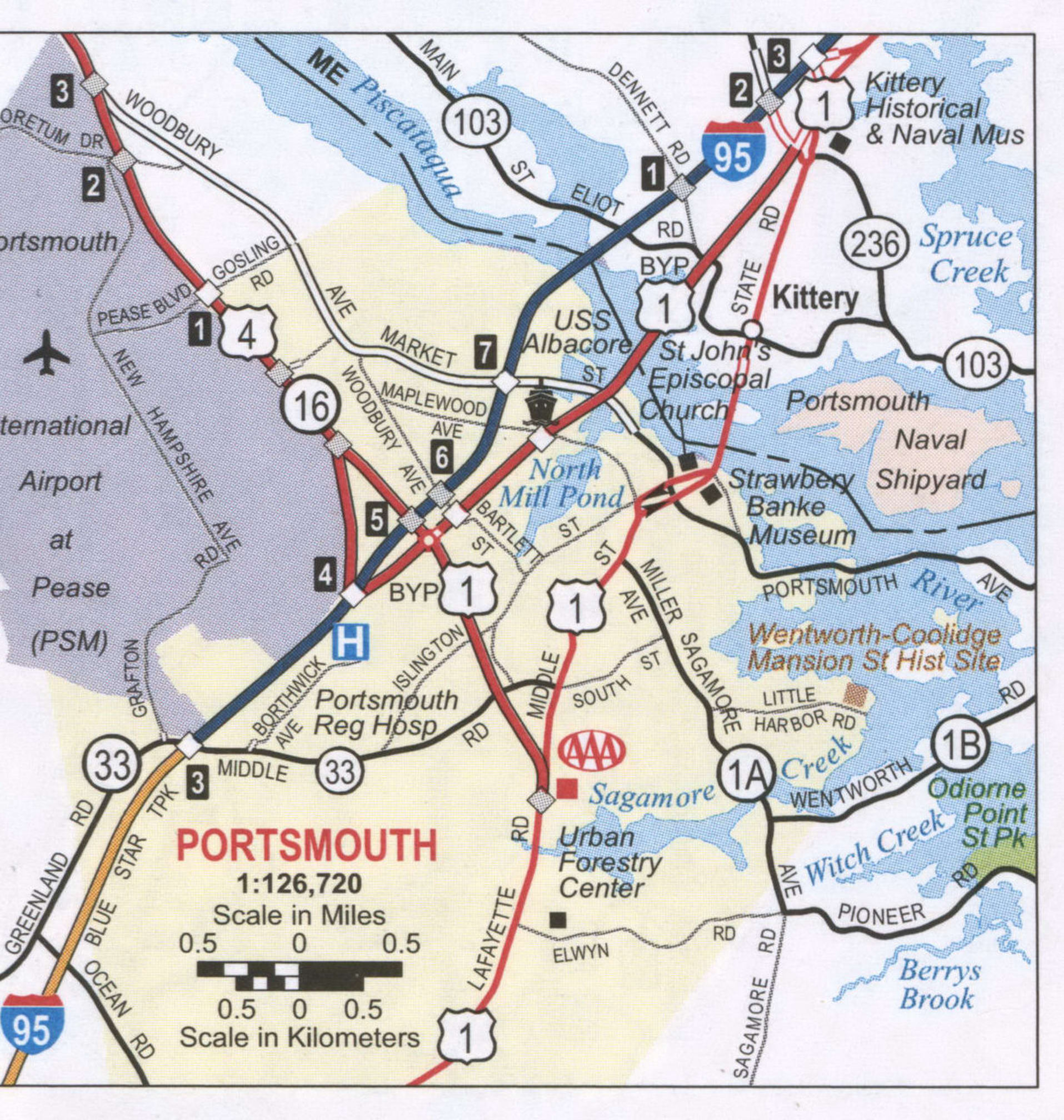

> USDA loans. Backed by the U.S. Department out of Agriculture (USDA), it financing is actually for low- so you’re able to reasonable-income homeowners looking to buy a house during the appointed rural parts. You are not needed to build a downpayment for a USDA financing, and you also routinely have low interest. As well as, mortgage words can get arrive at 38 decades.

Faq’s throughout the Kentucky’s very first-go out homebuyer programs

With regards to the FHA, a first-big date homebuyer is actually somebody who has maybe not had a first quarters during the last 3 years. Additionally could include a person who used property with a former companion during their relationship. Particular loan providers has actually looser significance from a first-go out homebuyer, so make sure you mention its particular significance when searching for a mortgage loan.

Given you meet the program’s standards for earnings, credit and you will possessions qualifications, you could qualify for down-payment recommendations when you look at the Kentucky.

Your own downpayment depends on the sort of real estate loan you get. For-instance, Virtual assistant and you may USDA finance don’t require off costs, if you are a keen FHA mortgage might require a deposit regarding step 3.5%. A normal basic-time homebuyer mortgage need an advance payment as low as 3%.

Home prices within the Kentucky continue to increase down seriously to reasonable property directory. For-instance, for the Fayette State (Lexington), average home prices increased nine.1% out-of last year so you’re able to $238,809, causing a monthly mortgage repayment regarding $906, that is $51 higher 12 months more seasons, according to the National Relationship of Realtors. Comparable increases have been found in Jefferson County (Louisville), and therefore watched median home values raise 9.2% so you’re able to $210,782 over the past 12 months, thumping upwards monthly mortgage payments from the $46, to help you $800.

> 4. Listen to people fees conditions, specifically if you propose to sell or re-finance. Specific apps require you to repay their assistance contained in this good specific time, so it’s crucial that you notice these types of fees schedules. For many who is the reason date limit expires, in addition, you may have to pay off a number of the guidelines loans. See these records initial in order to bundle consequently if needed.