Agreement of the supply from mortgage broker properties

Customer: an organic person who is utilizing (or will use) the Broker’s features and contains signed (otherwise tend to sign) it Arrangement with the provision regarding large financial company characteristics or features acknowledged (or encourage) the latest provisions for the Agreement to your provision out-of large financial company qualities utilizing the on the internet web app (

Broker: Akciju sabiedriba Direct Mortgage Money, registration Zero. 40103968207, judge address: Ganibu dambis step 3/1-8A, Riga, LV-1045, address of your actual place of supply of your own services: Pulkveza Brieza iela fifteen, 5th flooring, Riga, LV-1010, current email address:

Guarantor: an organic individual that are willing to bring a pledge to have brand new Customer’s debts as a result of a mortgage contract that may become signed as a result of using the Broker’s functions, and has now signed (or will sign) this Contract for the provision off large financial company properties otherwise has actually recognized (or will accept) the new provisions on the Contract into supply of large financial company qualities by using the on the internet websites application (

Whereas: (a) The client would like to utilize the Broker’s properties and you can found a great funding offer for an interest rate and other style of loan covered from the real estate; (b) Buyers get ask Guarantor as one of the loan’s securities; (c) The fresh new Agent is actually registered on Check in out of lenders and you will its agents managed of the Users Rights Coverage Hub (available online ) for the . to the membership Zero. KS-09; (d) New Agent cooperates multiple signed up lender and you will non-lender loan providers (hereinafter the lender or Loan providers) while the another representative.

If your terms of so it Agreement to the supply out-of large financial company services is actually authorized by the Customer about online net software or Customer possess closed this Contract throughout the face in order to face fulfilling or finalized that have electronical signature, it is thought that the customer in addition to Broker (hereinafter with each other/independently – the latest Activities/Party) go into which contract (hereinafter the new Arrangement) towards the following the conditions; Whatever the case, the fresh new Functions agree that the fresh new arrangements of your own Agreement use similarly to the Buyers therefore the Guarantor, except for the fresh conditions of your Contract in which only the Customers or the Guarantor is actually mentioned. In this situation, the appropriate clause of your Agreement is applicable merely to the brand new People (Customers otherwise Guarantor) known on the related term of the Arrangement

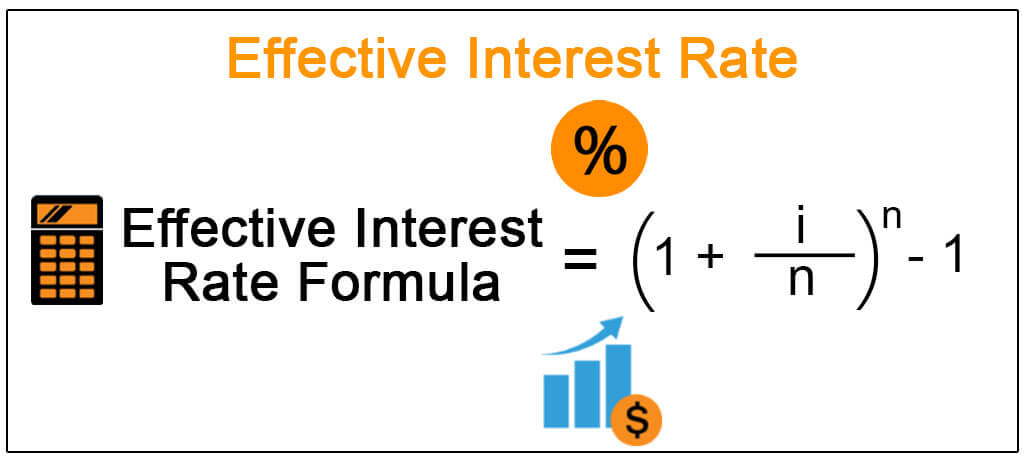

Financial obligation so you can money proportion calculator to have mortgage

In case your terms of the new Arrangement on the provision away from large financial company services try approved by the Guarantor on on the web web app or Buyers have closed it Contract during the face so you’re able to deal with meeting or closed that have electronical trademark it is believed that the Guarantor and Agent (hereinafter with each other/independently – the brand new Events/Party) enter into it contract (hereinafter – Agreement) for the pursuing the specifications; Whatever the case, the fresh Parties concur that the latest terms of one’s Agreement implement equally to both the Consumer while the Guarantor (hereinafter Most other Team regarding Contract), except for brand new clauses of Contract where just the Buyers and/or Guarantor was mentioned. In this case, the relevant condition of one’s Agreement enforce only to the brand new Cluster (Customers otherwise Guarantor) referred to on the https://www.paydayloancolorado.net/lamar/ related clause of your own Arrangement.

step 1. Subject of one’s Arrangement: step one.step 1. Using this type of Contract, the fresh Broker undertakes, using the applying of the other Class off the latest Agreement, to take all the needed measures on Consumer to get funding even offers in the Loan providers having an interest rate or any other types of off financing secured by the home. step one.2. Within the construction of the Contract, the fresh new Agent gets the adopting the properties to another People so you’re able to new Agreement (hereinafter – Services): a) The fresh new Representative collects the info and documents of your own Almost every other Class of your Agreement, essential for giving the loan, along with determining the skill of the consumer therefore the Guarantor (in case the Guarantor was welcome) to repay the mortgage; Studies collection are affected individually or in the form of net software setup and you can managed by Representative (hereinafter Online App) b) The new Agent functions a handbook data of one’s advice obtained, structuring the offer and you can preparing financing file for the lender; c) The newest Representative tells the customer concerning gotten resource even offers of Loan providers otherwise referring the client towards sorts of Bank (with respect to the brand of loan requested by Customers). step one.2. Whenever leaving the services referred to during the Clause 1.step one. or other relevant personal debt due to the new Agreement, the new Representative shall work genuinely, quite, transparently and you may professionally, taking into consideration this new legal rights and you will passion of one’s other Class into the Arrangement. 1.step 3. The client shall pay a fee on the Agent towards the provision off Attributes in accordance with the provisions of your Contract.