Chi town (WLS) — Running your own home is part of the fresh new Western Fantasy, but financial specialists state it’s is harder and work out a reality. Rising prices and better interest rates make they particularly problematic.

This is particularly true to have young individuals who are paying higher book and not capable cut enough. But there is however help readily available.

Conyears-Ervin said improving your credit rating may also help reduce steadily the interest you may be eligible for so be sure to was repaying debt on a regular basis, and not forgotten one credit card costs

«This new rising cost of living very made challenging and particularly planned on down-payment,» told you Julio Roman and you can Jessica Tristan who had been struggling to buy, but they are calculated becoming people.

«Your profile as soon as we get our very own household, it’s money that we’re investing in ourselves generally after which we are able to play with subsequent down the road when we will instead of only spending book rather than viewing one thing of that currency go back to all of us,» Roman said.

However, that monetary purpose is now much harder to reach. Present studies done by Zillow and you will Bankrate demonstrate that wages aren’t remaining up with costs.

«We’re talking about home values that have increased continually. And we have the highest financial interest inside the a manufacturing very both of these one thing combined extremely make for an incredibly, extremely difficult ecosystem to possess potential homebuyers,» told you erick, senior monetary specialist during the Bankrate.

The newest I-Class looked at the alterations into the can cost you during the last numerous years. Once the 1980, an average Make State household rate has increased more $75,000 when modified getting rising prices. Nevertheless the mediocre salary inside Make State only has increased of the about $8,five hundred.

Inside 1980, 60% off tenants in the Get ready Condition was able to spend less than simply a third of its money into book. Quick In the 2022, just about fifty% out of renters are able to save money than a 3rd off their earnings to your rent, making it more challenging so you’re able to in the course of time pick.

«You to getaways my personal heart to listen to your claim that, as they possibly can purchase a house,» told you Melissa Conyears-Ervin, Chicago’s City Treasurer.

«On CIBC, we have our own closure cost advice program, there are certainly others out-of different providers otherwise partners in the urban area to pile that really helps take your complete financial down since you have all one downpayment advice,» said Amy Yuhn, direct out of Individual and you can Area Development Financial for CIBC You.

«That’s 100 % free currency to help you set-out your own downpayment to get your own home especially very first time homebuyers,» Conyears-Ervin said.

Special mortgage applications can also reduce the fundamental 20% down payment. not, when you yourself have less down-payment, you’ll need financial insurance.

«Particularly if we discover ways to save your self directly from the paychecks and you will following i desire to save your self inside a top produce family savings. As little as $twenty-five a paycheck, start saving,» told you Conyears-Ervin.

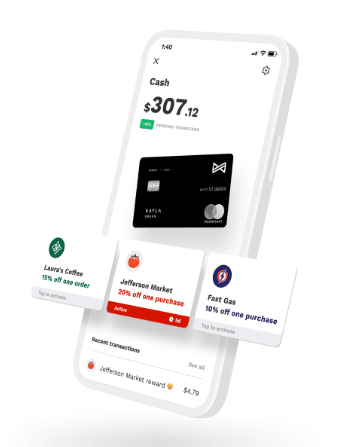

Almost every other tips to help save getting a down payment include investing in a loans Markets account, fool around with a profit-right back bank card and stash that cash.

Roman and his nearest and dearest told you to the help available, they will be capable move forward using their property fantasy.

And remember regarding rescuing your own income tax refunds

Rescuing getting a deposit could be more about remaining the new cash out from vision and you will regarding brain. For each and every deals alternative can easily be set up having automated transmits from the family savings.

- Automate deals. Set up automated transfers out of your examining to the family savings. Deposit a few of the paycheck directly into the savings account.