Us citizens over the You.S. is actually going out into the fresh new suburbs and you can rural parts-also it cannot feel like this pattern is certian anyplace anytime in the near future!

Some people ericans regarding towns and cities in order to suburbs try a beneficial Covid-19 powered technology. However, research means that it move first started well before the latest Covid-19 pandemic (in fact first started this season) and it has steadily increased to the current go out, where it’s still happening round the The usa inside 2023!

Based on that it Forbes summary of 2023 moving fashion , locations over the U.S. …saw decrease regarding almost 5 mil people that packed-up and transferred to new suburbs yet during the 2023-which change does not appear to be losing vapor.

That is where i can be found in. When you are a home consumer trying to proceed to a very rural city in the Iowa, you might keep reading! You will find a loan option particularly for Iowa customers looking a residential area out-of thirty-five,000 somebody otherwise shorter that needs an effective $0 down-payment.

What exactly is a beneficial USDA Outlying Development Loan?

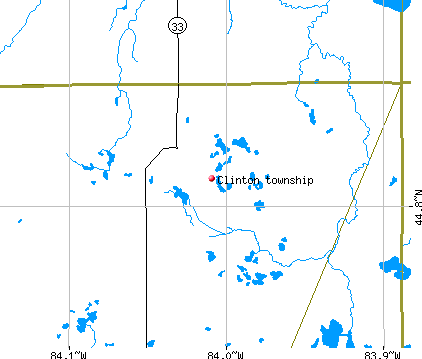

USDA money during the Iowa are available to consumers looking to purchase a house during the a residential area that have a populace off 35,000 otherwise reduced. So it surrounds Tiffin, Kalona, Swisher, Newton, Arizona, Williamsburg, Solon, Grinnell, Atkins, Palo, and even more. There are eligible metropolitan areas in all 99 Iowa areas! And you will a significant huge difference we should mention, rural does not mean you need to be living far pre approval installment loans out off culture! Most of these choices are contained in this travelling distance off close towns and cities and you can urban centers.

Of numerous Iowa customers meet the criteria for it program, so it is good choice, regardless of purchase price! It is a beneficial system your phase regarding buyer-first time otherwise next. To have first-timers specifically, it is a great way to enter a property with zero advance payment. To take benefit of the fresh Outlying Innovation Mortgage program, you need to meet the after the qualifications criteria:

- Occupy your house you may be to acquire as your first house

- End up being a good You.S. resident or permanent citizen

- Meet important borrowing requirements (640 or best credit rating)

- Create terrible wages for the 2023 USDA Income Constraints

Recently, the brand new USDA 2023 Iowa income constraints increased! It nevertheless differ from the county, however they are today more than these people were-actually this past year. Such as for instance, to possess a 1-cuatro people relatives that resides in Johnson State, the income maximum try $132,700, and for Linn State customers, it is $110,650. This new earnings limitation boost is excellent news for everyone just like the this means more people can be eligible for here mortgage program. When your RD money constraints nevertheless proper care you, remember that specific eligible monthly expenses is going to be subtracted. Let us estimate your revenue!

Home Status Standards

Some loan providers discourage utilizing the Rural Development loan because they state our home have to be within the prime standing. Which is simply not genuine! There are many criteria, but they are (normally) an easy augment or something like that that can be addressed initial. These requirements tend to be chipped/flaking painting, roof with lower than two years away from leftover lifetime, or shed handrails into staircase.

Your house status requirements to own an outlying Innovation financing aren’t stricter than any almost every other program. In the course of time, our home youre to order cannot enjoys these issues of the committed of the closure, regardless of the loan program you decide on, so don’t let that it dissuade your.

Fixed Rates Condo Financing having RD finance

Investment to own an apartment is different from capital to have just one-house otherwise a no-lot range. Particularly, specific loan providers simply promote a changeable-rates financial (ARM) if you are to acquire a great condominium-which could charge a fee even more ultimately!