.jpg)

A business owner should ignore salvage value when the business itself has a short life expectancy, the asset will last less than one year, or it will have an expected salvage value of zero. If a business estimates that an convert from pc to mac asset’s salvage value will be minimal at the end of its life, it can depreciate the asset to $0 with no salvage value. 60% depreciation is reported over 6 years and salvage value is 40% of the initial cost of the car.

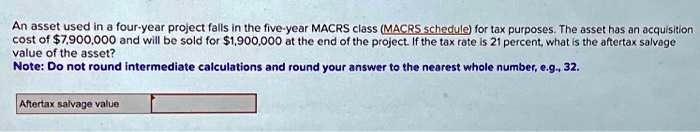

What is Salvage Value, and How to Calculate After-Tax Salvage Value?

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. Holding a Bachelor’s Degree in Business Management, Benjamin is responsible to organize and oversee the daily operations of our company. He is the one to ensure that our business is wellcoordinated and productive by managing its procedures and coaching our people.

Double-Declining Balance Method

A company can also use salvage value to anticipate cash flow and expected future proceeds. Book value is the historical cost of an asset less the accumulated depreciation booked for that asset to date. This amount is carried on a company’s financial statement under noncurrent assets.

- In some contexts, residual value refers to the estimated value of the asset at the end of the lease or loan term, which is used to determine the final payment or buyout price.

- The depreciation rate is influenced by the asset’s useful life, salvage value, and the method of depreciation chosen, such as the straight-line or double-declining balance method.

- In some cases, salvage value may just be a value the company believes it can obtain by selling a depreciated, inoperable asset for parts.

- Under straight-line depreciation, the asset’s value is reduced in equal increments per year until reaching a residual value of zero by the end of its useful life.

How is Salvage Value Calculated?

In accounting, an asset’s salvage value is the estimated amount that a company will receive at the end of a plant asset’s useful life. It is the amount of an asset’s cost that will not be part of the depreciation expense during the years that the asset is used in the business. Salvage value is an asset’s estimated worth when it’s no longer of use to your business. Salvage value refers to the estimated residual value of an asset at the end of its useful life.

The double-declining balance method is a depreciation technique used to calculate the reduction in value of an asset over its useful life. This method allows for faster depreciation in the earlier years and slower depreciation in the later years. By considering the after-tax salvage value, businesses can make strategic decisions about whether to sell an asset or continue using it. This calculation helps in evaluating the net benefit of disposing of an asset versus keeping it in operation. Furthermore, salvage value also aids in strategic decision-making related to the potential sale of depreciated assets for parts. When an asset has reached the end of its useful life, it may still have value in its individual components or as scrap.

With a large number of manufacturing businesses relying on their machinery for sustained productivity, it is imperative to keep assessing the equipment they own. Constant use and other factors like the nature and quality of these assets cause a continual deterioration. The original price or initial cost of an asset includes its purchase price, installation costs, and any other expenses incurred to bring the asset to a usable state.

The better the condition, the more valuable the asset is likely to be in the salvage market. Companies can also use comparable data with existing assets they owned, especially if these assets are normally used during the course of business. For example, consider a delivery company that frequently turns over its delivery trucks. Companies can also get an appraisal of the asset by reaching out to an independent, third-party appraiser. This method involves obtaining an independent report of the asset’s value at the end of its useful life.

This may also be done by using industry-specific data to estimate the asset’s value. In 1998, the company restated its earnings by $1.7 billion – the largest restatement in history. Other commonly used names for salvage value are “disposal value,” “residual value,” and “scrap value.” Net salvage value is salvage value minus any removal costs.

On the other hand, neglected or poorly maintained assets may have a reduced salvage value due to their diminished condition. Salvage value and depreciation are both accounting concepts that are related to the value of an asset over its useful life. This means that of the $250,000 the company paid, the company expects to recover $40,000 at the end of the useful life. Since technology is not going anywhere and does more good than harm, adapting is the best course of action.

Yes, salvage value can be considered the selling price that a company can expect to receive for an asset at the end of its life. Therefore, the salvage value is simply the financial proceeds a company may expect to receive for an asset when it’s disposed of, though it may not factor in selling or disposal costs. If your business owns any equipment, vehicles, tools, hardware, buildings, or machinery—those are all depreciable assets that sell for salvage value to recover cost and save money on taxes. Depreciation represents a reduction in the asset’s value over time due to wear, tear, and obsolescence. Calculate accumulated depreciation up to the disposal date using your preferred method (straight-line, declining balance, etc.), ensuring compliance with relevant accounting standards. Companies can also use industry data or compare with similar existing assets to estimate salvage value.

Salvage value is the monetary value obtained for a fixed or long-term asset at the end of its useful life, minus depreciation. This valuation is determined by many factors, including the asset’s age, condition, rarity, obsolescence, wear and tear, and market demand. Besides, the companies also need to ensure that the goods generated are economical from the customer’s perspective as well. Overall, the companies have to calculate the efficiency of the machine to maintain relevance in the market. By integrating financial data and automating calculations, Deskera ERP ensures accuracy and consistency in determining salvage values across various asset categories.