Strategic decisions, such as aggressive expansion or acquisitions, can also contribute to negative retained earnings. While these moves may be made with long-term growth in mind, they can require substantial upfront investment, leading to short-term financial strain. If these strategies do not yield the expected returns quickly enough, they can result in a sustained period of negative earnings. When a company consistently retains part of its earnings and demonstrates a history of profitability, it’s a good indicator of financial health and growth potential.

What affects the retained earnings balance?

- During its current year, an unexpected decline in economic conditions results in a sharp drop in its sales, triggering a loss of $100,000.

- Retained earnings are reported under the shareholder equity section of the balance sheet while the statement of retained earnings outlines the changes in RE during the period.

- So, retained earnings are the profits of your business that remain after the dividend payments have been made to the shareholders since its inception.

- To understand negative retained earnings, it’s best if we define what it is and how it affects your business.

- A summary report called a statement of retained earnings is also maintained, outlining the changes in RE for a specific period.

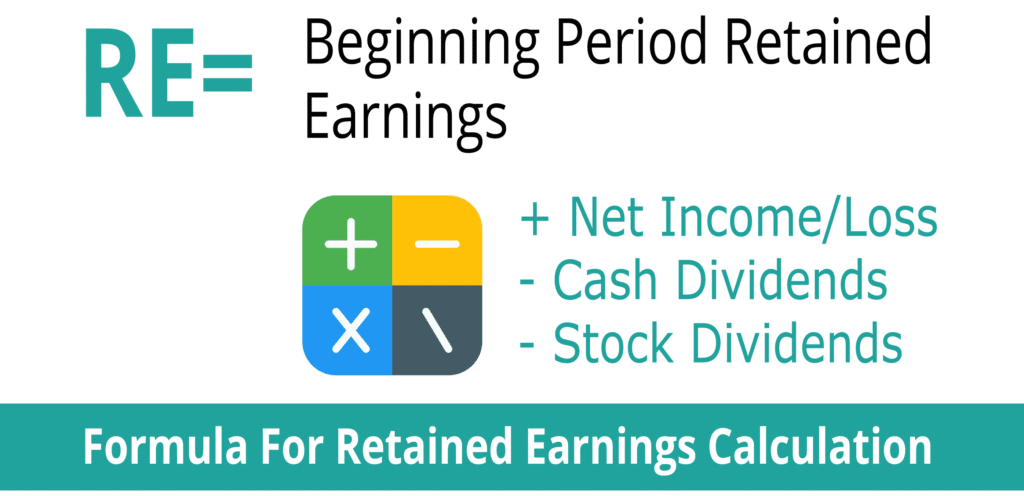

This balance can be both in the positive or the negative, depending on the net profit or losses made by the company over the years and the amount of dividends paid. The beginning period retained earnings is the previous year’s retained earnings, as appears on the previous year’s balance sheet. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Retained earnings are calculated through taking the beginning-period retained earnings, adding to the net income (or loss), and subtracting dividend payouts.

Retained earnings on the balance sheet

Such items include sales revenue, cost of goods sold (COGS), depreciation, and necessary operating expenses. For example, during the period from September 2016 through September 2020, Apple Inc.’s (AAPL) stock price rose from around $28 to around $112 per share. During the same period, the total earnings per share (EPS) was $13.61, while the total dividend paid out by the company was $3.38 per share. It involves paying out a nominal amount of dividends and retaining a good portion of the earnings, which offers a win-win. If the company’s financial situation is dire, it may be necessary to raise capital by taking on additional debt or seeking additional investments from venture capitalists or angel investors. If you’re investing in growth stocks or tech startups, recognize that retained earnings don’t provide the full picture.

How are retained earnings different from dividends?

For instance, if a company pays one share as a dividend for each share held by the investors, the price per share will reduce to half because the number of shares will essentially double. Because the company has not created any real value simply by negative retained earnings announcing a stock dividend, the per-share market price is adjusted according to the proportion of the stock dividend. If a company consistently operates at a loss, it’s possible, though less common, for retained earnings to have a debit balance.

It shows a business has consistently generated profits and retained a good portion of those earnings. It also indicates that a company has more funds to reinvest back into the future growth of the business. It’s important to note that retained earnings are cumulative, meaning the ending retained earnings balance for one accounting period becomes the beginning retained earnings balance for the next period. Positive retained earnings signify financial stability and the ability to reinvest in the company’s growth.

Retained earnings refer to the portion of a company’s net income or profits that it retains and reinvests in the business instead of paying out as dividends to shareholders. It’s an equity account in the balance sheet, and equity is the difference between assets (valuables) and liabilities (debts). After adding/subtracting the current period’s net profit/loss to/from the beginning period retained earnings, you’ll need to subtract the cash and stock dividends paid by the company during the year. In this case, Company A paid out dividends worth $10,000, so we’ll subtract this amount from the total of beginning period retained earnings and net profit. Retained Earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate RE, the beginning RE balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted.

However, its auditors also force it to write off $250,000 of unsold shoes, which results in a negative retained earnings balance of -$50,000. They are a measure of a company’s financial health and they can promote stability and growth. Retained earnings are the portion of a company’s cumulative profit that is held or retained and saved for future use. Retained earnings could be used for funding an expansion or paying dividends to shareholders at a later date.

The figure is calculated at the end of each accounting period (monthly/quarterly/annually). As the formula suggests, retained earnings are dependent on the corresponding figure of the previous term. The resultant number may be either positive or negative, depending upon the net income or loss generated by the company over time.