A personal bank loan try a money merchandise that lets a borrower to help you quickly rating fund which you can use for almost one objective, together with scientific expense, debt consolidation, otherwise vehicles fixes.

A mortgage are a mortgage always money the purchase out of a house, that’s paid back over 20 otherwise thirty years. If you’re a personal loan is a general-mission mortgage, a mortgage is employed for real home requests.

Secret Takeaways

- An unsecured loan lets a borrower in order to easily get money that can be used for almost people objective, also scientific expenses, debt consolidation reduction, otherwise car solutions.

- A personal loan is usually unsecured, definition there’s no security backing the mortgage.

- Mortgages usually are always purchase home and are shielded by the possessions bought towards the financing.

- Unsecured loans usually can getting financed faster than simply mortgages, nonetheless they might have large rates of interest.

- Home financing always needs alot more rigid prerequisites, as well as an assessment of the property.

Personal bank loan versus. Mortgage: An overview

One best personal loans in Florida another personal loans and you will mortgage loans are version of loans. A loan provider will provide you with capital initial, therefore pay the lending company over the years. Also paying off the bucks your debt (called the prominent), you have to pay notice, which is the fee you pay for using new lender’s money and also make your purchase.

Personal loans and you will mortgages is both installment financing, very you will understand whenever you’ll end up over paying off the debt. These types of fee dates might have repaired otherwise varying interest rates. With a fixed rate, you pay an equivalent matter monthly, as notice payment doesn’t alter. A varying rates, even when, can alter. As a result when the rates go up, the lowest payment will raise to store your toward track to repay the borrowed funds inside consented-upon time frame.

Each type regarding mortgage may additionally feature various fees, including the likelihood of an enthusiastic origination payment to help you procedure a loan software. When evaluating the mortgage conditions, make sure you understand what trying out loans might cost your, no matter whether you get a personal bank loan otherwise a home loan.

You will need to mention, however, one to signature loans are (yet not always) unsecured, so if you neglect to make money, the latest lender’s fundamental recourse would be to sue your or publish your membership so you’re able to choices. Simultaneously, a home loan is used buying a property, so if you are unable to generate repayments, the lending company is also repossess the house and then try to sell it to recoup a number of the currency which they discussed.

Unsecured loans

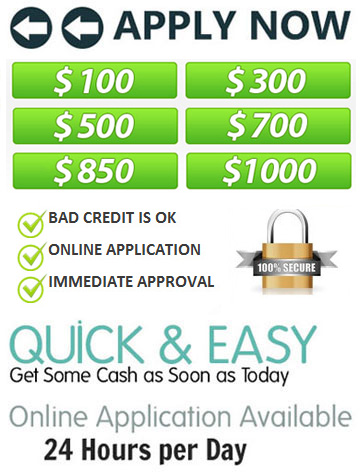

Signature loans are often unsecured, meaning they won’t require that you bring security because coverage inside the case away from nonpayment. With regards to the financial, you can borrow as low as $1,000 or around $fifty,000 or maybe more. Installment terms usually history a couple of so you can 5 years, although that including are very different because of the lender.

Specific lenders promote secured loans. If so, you might have to put down anything valuable given that equity, such a motor vehicle term otherwise a checking account. With regards to the financial, it would be you are able to to locate a lower rate of interest if the you may be willing to offer equity.

Rates of interest to your signature loans may run the gamut, depending on the financial plus credit rating. When you have a high credit score, you are qualified to receive a high loan amount and you will good all the way down interest rate. At exactly the same time, a lowered credit rating might result inside the a high rate of interest and you may limitations how far you could use.