What’s a DSCR financing?

DSCR, or Loans Solution Publicity Proportion, try a financial metric accustomed measure the element out-of a keen income-generating possessions to pay for the debt burden. Relating to investment, they steps the fresh new property’s capability to build adequate leasing income to help you safeguards the borrowed funds money.

Because of this the key qualifying factor is the financial support property’s real otherwise potential income, in place of an excellent borrower’s personal money. There isn’t any Obligations-to-Money Proportion calculation, no private earnings confirmation.

MiMutual Financial understands the unique need regarding a home investors. From the concentrating on brand new property’s actual/potential lease unlike private income, DSCR funds open up a full world of chance to individuals who do not have old-fashioned earnings, for those who have several investment properties and for people who’re just starting its a home travel.

In the 2023 Cheapest Places to have Homebuyers statement because of the WalletHub, and therefore ranked towns and cities in the united states of the calculating the cost of lifestyle, construction affordability and you can maintenance cost, 3 of top ten was basically Michigan places. Flint, Michigan ranked given that second most affordable town in the united states, which have Detroit and you may Warren rounding-out record. As well as in RentCafe’s 2024 list, Michigan’s cost of living is cuatro% below the latest federal average, when you are houses try ten% below all nation!

MiMutual Financial now offers FHA funds and you may Deposit Recommendations Apps to possess buyers which have confronted borrowing from the bank, absolutely nothing currency saved or the individuals shopping for a resources-friendly domestic.

FHA finance:

Federal Casing Management money are a great choice for first-date homebuyers with little saved to possess a downpayment, individuals having lower-to-moderate earnings and those having down fico scores. These types of money would be more straightforward to qualify for than simply conventional money and need a beneficial 3.5% lowest down payment (which is 100% gifted) and you can at least credit score away from 580.

For consumers which need down-payment guidelines, MiMutual Mortgage now offers many different federal and you will condition DPA applications. DPA’s provide first-some time repeat consumers an approach to reduce if you don’t treat the away-of-wallet can cost you to pay for downpayment and settlement costs. This type of apps enforce in order to both FHA and you may Traditional mortgage loans.

Just like the an approved Michigan County Casing Creativity Authority (MSHDA) lender, MiMutual Mortgage offers the MSHDA MI 10K DPA, (which supplies to $10,000 to own individuals state-wide) and also the Mortgage Borrowing from the bank Certificate (MCC) Federal Tax Credit, that gives a dollar-for-buck credit on the mortgage interest your reduced yearly.

And these types of state apps, Michiganders may benefit out of numerous local area and condition down-payment guidelines software. Some examples are, The metropolis from Warren Head Homebuyer Guidelines System, the brand new Port Huron Urban Pioneer System, The new Wayne Condition National Faith DPA and the Grand Rapids Homebuyer Assistance Fund (HAF) to mention a few.

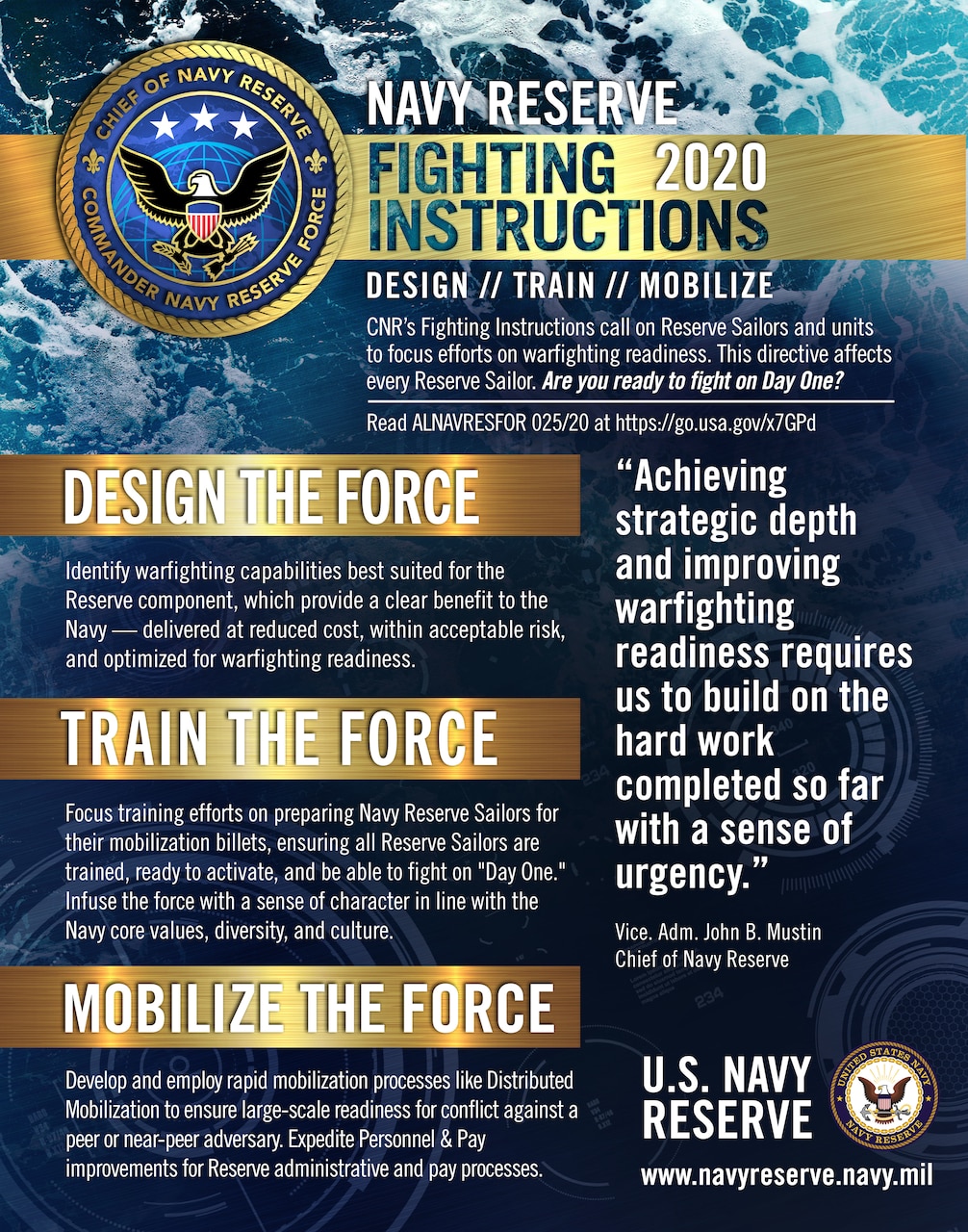

Are you a seasoned willing to put down sources?

On the 2019 Good for Vets Show, Military Minutes guide performed a study of fast payday loan Severance Colorado where best metropolitan areas having Veterans to reside the us is. 599 locations all over the country had been analyzed towards the about three significant items: the means to access seasoned services and you may military people, the effectiveness of neighborhood benefit and you may livability circumstances particularly offense, fitness, guests, and you will university high quality. Troy, MI and you can Sterling Levels, MI each other landed about top 50.

MiMutual Financial understands exclusive need out-of Pros. With the help of our Va mortgage program, Veterans, Energetic Obligations, and you will qualifying partners can acquire 100% resource, meaning zero downpayment called for! Our very own Virtual assistant funds offer versatile qualify guidelines, down credit rating standards plus don’t charges an enthusiastic underwriting fee.