That have a watch for the significant progress supported by the possible aversion so you’re able to refinancing in the middle of high rates, Philadelphia-based home security financial Spring EQ keeps launched a pair of key additions so you’re able to shepherd its expected expansion.

You will find fixed-rate domestic equity financing, and now we has actually household guarantee HELOC that delivers a whole lot more liberty to help you the client

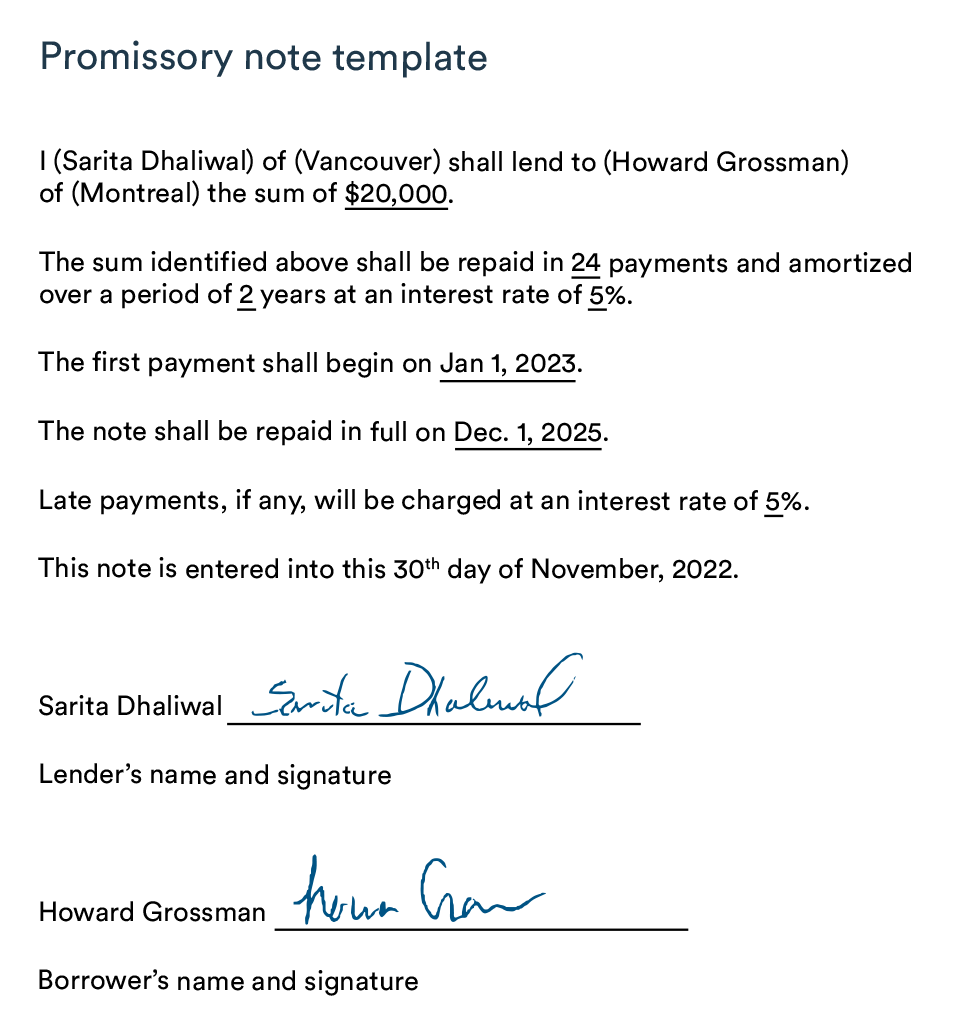

David Haggert (envisioned best correct) provides inserted the organization because captain sales officer while Peter Schwartz (pictured less than) are leased since the senior vp off associated lending.

This year, he wants after that expansion so you can more than 400 group with a great 70% escalation in volume home based equity business.

The cause of the rise inside the personnel is by using the brand new recent rise in rates, we feel you to definitely house security funds and you will find from the the growing company get a little more about essential in the long run once the people should not refinance a very low-rate first-mortgage, the guy explained. They wish to remain their lower-price first-mortgage in lieu of providing bucks-out of refinancing.

Aiding in this increases might possibly be Haggert along with 25 years out of product sales experience in the insurance and economic attributes having supervision for the strategic considered, brand name innovation and you can prospecting operate. Haggert previously offered given that manager vice-president regarding direct-to-individual sale to own Liberty Financial and captain sale administrator that have NewRez. He together with held earlier in the day ranking which have Ocwen and you will GMAC Financial.

Including shepherding growth is Schwartz, which have obligations to have initiating the business’s the fresh new correspondent route throughout the earliest quarter of season. Before joining Spring season EQ, Schwartz invested 2 decades having Mr. Cooper/Nationstar Financial in which the guy kept numerous elderly management positions controlling procedures to the business’s correspondent station, going upwards strategic initiatives and you can helping just like the master guidance manager. He brings 35 several years of financial community expertise in a variety away from design, servicing and personnel opportunities, Schiano told you.

Within the declaring the newest hirings, Schiano promoted each other men’s room electronic options and you may leadership event that would be important …for the bringing customized alternatives for everyone types of people.

Inside a telephone interview which have Financial Professional The united states, Spring EQ President Jerry Schiano told you his team among country’s largest low-depository loan providers targeting delivering home security contours and you will finance to help you consumers knowledgeable fast development last year, increasing to help you three hundred professionals regarding 230

Asked in order to expound, Schiano added: I have a robust product line you to provides users that a lot of collateral as well as have suits particular users whom has just ordered their home who’ve a small amount of security. So, i’ve some large LTV [financing in order to worthy of] products offered, and several antique activities. The average FICO score in our consumers is approximately 750; i wade as low as 640 on occasion for consumers. All of our products is really wide.

But really company growth forecasts are in fact mostly contingent for the resident resistance so you can refinance in the midst of predicted rate of interest grows. Due to the fact coming is actually unknown, Schiano appears positive about hedging his wagers: Our company is from inside the a crazy day, and it’s tough to anticipate where things are going, the guy said. Exactly what I could inform you is when you’re taking a review of where the first-mortgage cost was, economists expect when your prices go from in which they started out the year during the step three-4%, that cut in half of the refinance industry. Just what which means try users still have to borrow, they’ll prefer other means whether they end up being domestic guarantee funds, or unsecured loans otherwise handmade cards. Exactly what they will not do is actually refinancing during the 2.5% basic to get in an excellent 4% very first.

While you are not one person and also the fresh fabled amazingly golf ball, the brand new central bank’s telegraphing of high interest rates in the course of inflationary stress functions as fodder in the midst of the subject his providers possess created aside.

There is certainly listing home equity, as there are different ways to faucet family security, the guy said. And you can last year, people stolen one to using refinancing the first mortgage. But with rising cost, particular people would not want to re-finance their first-mortgage. They want to cash-out through other form, and you can the device is a cool product to help people pay or consolidate loans, to borrow cash to improve their houses. And you may, plus, in some instances the people have fun with a moment financial thus as an alternative of going to a jumbo first-mortgage they will certainly head to a good Fannie mae first-mortgage and employ the second mortgage piggyback. And you can generally, that can assist them to get a better first mortgage price.