Immediately after a property foreclosure, protecting a different home loan is tricky. Lenders consider people with foreclosure on their listing as the highest-exposure individuals. Even though you create qualify for another type of mortgage, other kinds of mortgage brokers, for example house collateral finance or household guarantee credit lines, is almost certainly not available to choose from. And, though home financing app gets acknowledged, it have a tendency to comes with unfavorable terms and conditions such as for instance higher down money, enhanced rates of interest, and you will more strict lending standards.

Also, really loan providers wanted a standing up age several years shortly after a good foreclosure just before they thought another mortgage app.

During this time period, somebody may also face increased scrutiny of cash verification and you will employment stability, very implementing reconstructing your own borrowing and you may monetary fitness inside the prepared months is essential if you wish to safe property loan later on.

Higher prices to own future fund

Past houses, a foreclosure can impact everything and come up with they much more pricey. Regardless if you are capital a car, consolidating debt, or taking out fully a consumer loan getting an emergency, the newest increased interest rates stemming of a lowered credit history normally compound existing financial problems, so it’s more complicated to move submit.

Additionally, while the lenders perceive people who have a property foreclosure within credit history since the greater risk, these types of borrowers tend to get undesirable conditions besides improved rates of interest, and stricter mortgage criteria or denial regarding borrowing. Brand new ripple ramifications of elevated pricing can last for age, which have a lot of time-identity ramifications that can shape your financial coming.

Income tax effects

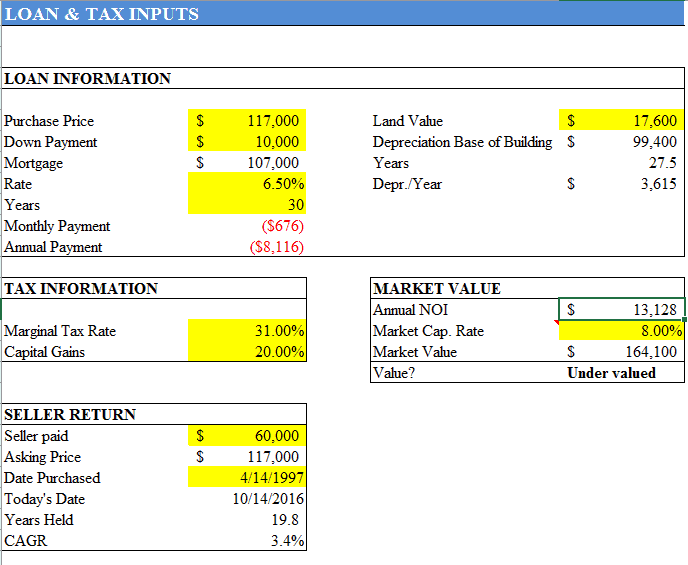

Of many individuals don’t realize the new tax effects out-of a foreclosure. If the bank chooses to forgive or dismiss a portion of your own mortgage, the Internal revenue service ount since the nonexempt money, definition you’ll be able to pay income taxes thereon amount. This leads to unexpected tax debts, then pushing your individual finances while you are speaing frankly about losing in your home.

In other words, throughout the eyes of your own Irs, obligations forgiveness might be equated in order to searching money even if no bucks enjoys exchanged hand. The newest recognized benefit is named cancellation out installment loans Mississippi of financial obligation money, which is said from the lenders. Some body might also want to statement that it to their tax return.

Mental strain

Beyond the tangible affects, discover the effects regarding foreclosures that cannot feel measured. The increasing loss of a house, emotions from insecurity, and also the worry off an ambiguous upcoming tied to property foreclosure can be trigger sleepless nights, stress, and strained family members personality.

Emotional strain is normally exactly as daunting once the monetary effects. Memories and you can emotional opinions connected with property succeed a beneficial seriously personal losses. The mental cost is also expand to feelings out-of embarrassment otherwise guilt, especially if the private feels he’s got unsuccessful for some reason.

Steer clear of Property foreclosure

Residents don’t need to become powerless whenever against foreclosure. The simplest way to prevent property foreclosure will be to stand proactive and you may take control of your cash while keeping an unbarred type of telecommunications that have your bank. On a regular basis looking at your finances, setting aside an emergency money, and you will requesting guidance can supply you with a back-up.

- Refinancing until the foreclosure procedure starts: If you think the newest financial strain of your mortgage, it certainly is far better think refinancing before missing a repayment. When you yourself have equity at home and meet with the lender’s certificates, refinancing may cause a reduced interest rate otherwise longer loan name, each of which decrease your monthly payments. You’ll be able to sign up for a recent borrowing from the bank knowledge mortgage in the event that your credit rating was already affected by overlooked mortgage payments and other borrowing from the bank events. Which restructuring now offers way more breathing place if you’re experiencing financial difficulties and certainly will help you hold your property throughout the difficult times.