Virtual assistant funds, supported by the fresh U.S. Agency out-of Pros Situations , have long become a way to obtain a cure for provider professionals, experts, in addition to their parents. These finance are created to generate homeownership so much more available, offering positive terms and you may unique positives.

Yet not, the trail so you’re able to homeownership isn’t always easy, and frequently consumers could possibly get talk about other options so you can safer property mortgage. One particular choice is the fresh new inclusion off good co-signer, a habit that the place in the realm of Va fund.

On this page, we shall look into the role from co-signers in the context of Virtual assistant finance, providing understanding of when and exactly why consumers might look at this channel.

Given a Va loan having a co-signer? The procedure can be complex, but with best advice, you can attain your dream off homeownership. https://paydayloanalabama.com/west-jefferson/ Contact Dash Resource today ! All of our knowledgeable financial specialist makes it possible to from the inner workings of Virtual assistant finance that have co-signers and ensure you earn the very best terminology.

What’s the Role out of Co-Signers home based Financing?

Co-signers play a crucial role in home funds. He is those who get in on the primary debtor within quote for homeownership, offering its resource and you can creditworthiness to strengthen the mortgage software .

Co-signers is going to be an excellent lifeline just in case you could possibly get deal with demands in the meeting the newest strict requirements place because of the loan providers, whether because of borrowing products, income limits, or any other activities.

Knowing the figure from co-signers in the context of Va financing is vital, as possible open doorways to homeownership that may otherwise are still signed.

The basics of Va Financing

Virtual assistant finance, quick having Veterans Items money , try a kind of real estate loan system made to help solution people, experts, and you will eligible surviving spouses inside gaining homeownership. He or she is provided by personal loan providers but they are secured because of the U.S. Department away from Experts Affairs, decreasing the chance for lenders and you will enabling consumers to gain access to so much more favorable terminology.

An important intent behind Va loans is to bring affordable and you may available homeownership chances to those who have offered or try helping throughout the U.S. military . This type of funds give many perks, and no down-payment requirements, competitive rates, and flexible degree conditions.

Top Borrower Qualification Requirements

Virtual assistant loans are available to a certain gang of people that fulfill qualifications conditions put by the You.S. Agencies from Veterans Items. To qualify because primary debtor for a Va loan, an individual generally speaking should see criteria connected with the army service, launch updates, or other issues.

These conditions make sure that Va financing try directed for the people who possess supported their nation and you may meet up with the required qualifications.

Benefits of Virtual assistant Fund

The great benefits of Va loans is multifaceted and you can join the dominance certainly qualified consumers. Virtual assistant finance give gurus including:

- No down-payment requirement : Individuals is also loans 100% of the home’s price.

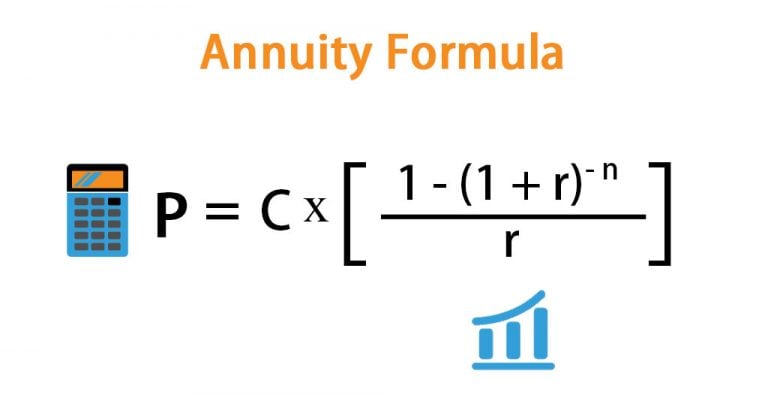

- Competitive rates of interest : Virtual assistant funds commonly ability straight down interest levels than old-fashioned mortgages.

- Limited closing costs : The Va limitations certain closing costs, reducing the economic burden towards consumers.

- Zero private financial insurance coverage (PMI) : Virtual assistant financing none of them PMI, further cutting monthly premiums.

- Flexible borrowing from the bank criteria : Va fund could be so much more flexible off borrowing circumstances compared to the antique funds.

The concept of a great Virtual assistant Loan Cosigner

An effective co-signer, in the context of a beneficial Virtual assistant financing, was an individual who agrees to fairly share economic duty to your financing on the no. 1 borrower.

The co-signer’s part is always to promote a lot more guarantee into the lender you to the loan could be repaid , and is specifically helpful if the number one borrower’s creditworthiness otherwise financial situation doesn’t meet with the lender’s requirements.