Examining Minnesota Home loan Choices

You can rest assured about this, locating the best home loan for yourself or the ones you love can seem to be such as a daunting if you don’t challenging task. Whether or not you’re an initial-day homebuyer, buying your dream domestic, downsizing, turning, expenses otherwise searching for something different entirely, Lake Urban area Home loan even offers numerous alternatives for the house pick.

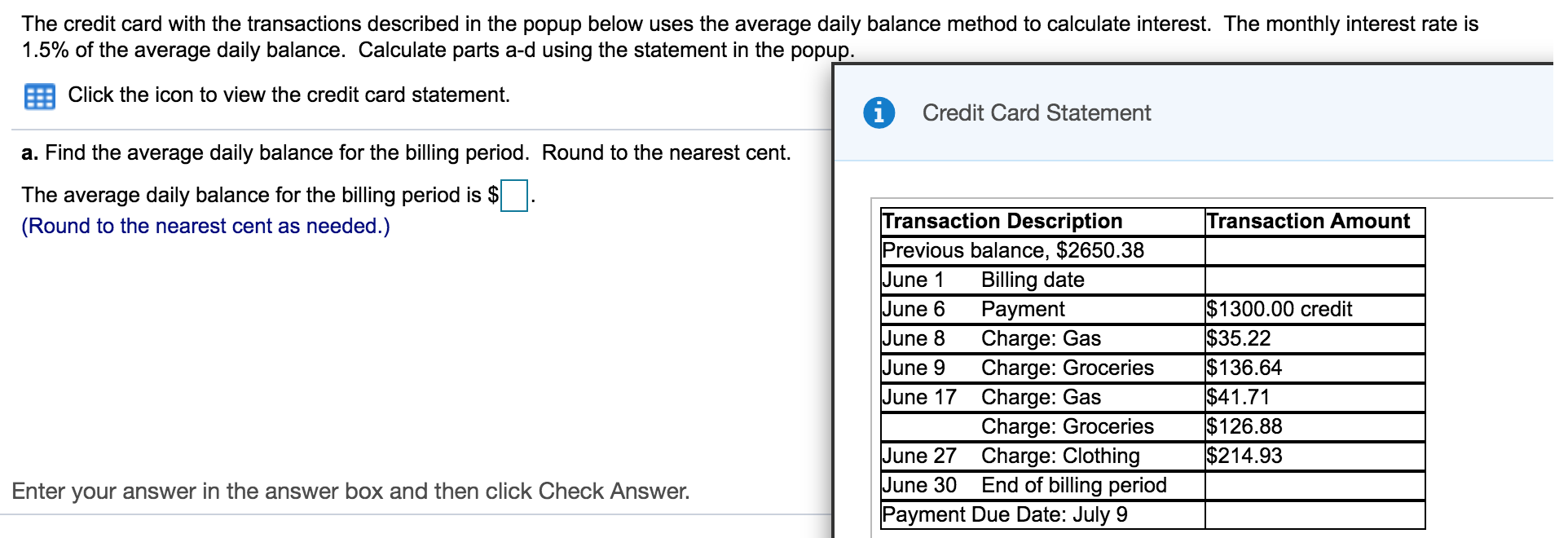

Through the so it financial homebuying book we shall show the many systems regarding mortgages, the pros, and you may prospective downfalls of every, and you may develop assist you in deciding and therefore home loan form of is perfect for your situation. Let’s start off!

Financial Models:

There are two main brand of mortgages, fixed speed & changeable speed. In payday loans Mill Plain this both of these chief kinds you can find a multitude of subcategories so you’re able to customize the commission intentions to for every consumers’ means. If you’re here of course are other mortgage options, this really is an intensive look at what most buyers use because the a lending automobile to order the first household.

Traditional Fixed-Rate Loan

Within sorts of mortgage, the rate is restricted in the very beginning of the loan and you will stays constant about life of the borrowed funds. Such home loan get meet your requirements better if you:

- Need protection of creating a stable, foreseeable payment few days-to-few days

- Are planning to stay in our home into lasting (Basically 5+ years)

A zero closure rates alternative otherwise low closing costs choice significantly reduces the amount of cash you would like at the closure since it talks about your own third-group charge and you can waives financial origination charge. On Lake Area Mortgage, we can promote eligible homeowners book software through the Minnesota Property Money Company that help with your situations. You’ll be able to have an advance payment and need money to own prepaid reserves (such as for instance assets fees, home insurance, and you will prepaid focus), however, this is certainly good solution if you would like bring less money in order to closure. The interest may potentially become quite highest, but there is however no prepayment penalty or hidden constraints. This may match your financial demands smart to:

- Have little money getting closing available to you or need certainly to save money profit hands upfront

- Is a primary-day homebuyer

Va Home loan

Through the GI Statement from 1944, if you find yourself a veteran of one’s military, an excellent widowed military lover, otherwise a working obligations provider associate, you could potentially get good Va financial to shop for an effective domestic. The application was created to allow it to be more relaxing for qualified purchasers attain the key benefits of homeownership. Rates of interest can be better than old-fashioned costs and there is no lowest down-payment! This means many eligible people can purchase with 0% down. This loan can get suit your financial needs wise to:

- Was an active obligation service member, veteran, otherwise an eligible friend

- Try having to financing around 100% of the home

- Keeps a minimal credit history & enjoys a high loans-to-income proportion

Jumbo Financial

Speaking of such as for example it sound larger funds. If the loan are higher and it also exceeds the new conforming loan maximum within city ($726,200 in the 2023), next a jumbo mortgage is needed towards the funding. Having a good jumbo loan you might financing your perfect domestic and you will take advantage of the finer privileges away from Minnesota. So it loan get match your economic requires best if you:

- Are thinking about a property with a cost regarding $726,200 otherwise better

- Require increased amount borrowed that have a competitive attract rates