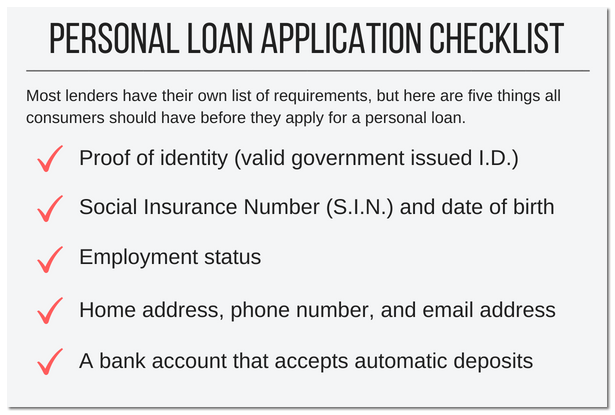

Qualification requirements

And you will like most old-fashioned loans (instead of FHA money, such) you typically you desire a good credit score-a minimum of 620 in cases like this, proof of money, and a minimal personal debt-to-earnings ratio in order to meet the requirements, essentially zero higher than 43 percent.

You might, with a HomeStyle financing, get a maximum financing-to-worth (LTV) ratio off 97 % towards a predetermined-rates mortgage for a single-tool priily home). Having a two-equipment number one family, you can purchase doing 85 per cent LTV and you may 75 percent LTV having a beneficial about three- or four-unit primary domestic. To own the next domestic, you can aquire around 90 % LTV.

You nonetheless still need in order to create a down-payment so you can purchase a property on the HomeStyle loan, which amount is founded on new projected value of the latest domestic. So if you get the restrict 97 % financing, you would have to put down step three per cent of your projected residence’s well worth shortly after renovations and you may fixes was indeed finished.

You really need to have their renovations accepted in advance to help you be eligible for good HomeStyle mortgage. This consists of having a lender-acknowledged specialist positioned having agreements drafted to demonstrate the financial. Become accepted, general contractors must be signed up or joined. There’s also a good do-it-yourself selection for one to-tool characteristics if for example the complete work stands for no more than 10 per cent of one’s complete value of the house.

Their repair will set you back will be just about 75 per cent of the whole price also restoration will set you back or even the finished appraised property value the house, any type of is smaller.

You simply can’t rip down a current household and reconstruct, definition you can not remove the entire layer as a result of the origin, therefore never make an alternative independent hold for the property. You could, but not, redesign and work out additions so you’re able to a current house or apartment with the latest HomeStyle mortgage.

Great things about the latest HomeStyle mortgage

You may make any restoration on family you for example as long as the project was attached to the home. You are able to improvements to your house such as for example a good sunroom, a guest suite, or an additional toilet, such as for example, however you are unable to generate an entire separate dwelling towards the assets.

You may also make use of the HomeStyle mortgage for a beneficial refinance. The advantage is that you will determine the property’s value just like the as being the accomplished really worth following the restoration in place of just what domestic create appraise for until the repair.

Opportunities of the HomeStyle financing

New HomeStyle Recovery loan makes it possible for that get and you will enhance a home that have that mortgage, ideal for people that don’t have the cash to cover home improvements and you can fixes.

You can also buy a house it is not habitable on HomeStyle Repair loan. This is exactly you are able to as you can acquire doing half a year off home loan repayments, in addition to interest, taxation, and you will insurance rates, allowing you to live elsewhere while you work at your house.

The new HomeStyle loan reveals a new markets out of home to pick from, letting you escape the newest crowds of people vying to possess disperse-within the in a position starter property.

When you find yourself seeking to shop https://paydayloancolorado.net/wiley/ for a smaller-than-primary family that one may res, envision trying to get a beneficial HomeStyle Recovery loan through loanDepot. A Subscribed Lending Officials could well be happy to go more than the merchandise to you and you can respond to any questions you may also has. Succeed one of our registered credit officials to guide you using the process of resource any project and flipping a home into the home to their desires.

Observe that you would need to abide by people homeowner’s organization laws when designing renovations. When it comes to an apartment or co-op, most of the works should be confined so you can inside.