Lender off America Corp. (BAC) is just one of the prominent financial institutions global, which have approximately $step 3.twenty-seven trillion for the possessions and a customer base of about 69 billion consumers and smaller businesses. The business provides customers and individual consumers, higher enterprises, high-net-well worth anybody, and governing bodies. Financial out of The usa is additionally among the eldest creditors in the usa, with some components of the company oriented 240 years back.

Today, the company splits its products and you will characteristics toward five markets: Around the world Financial, In the world Segments, User Banking, and you can Global Money and you may Money Administration. Into the 2023, Lender off The usa reported $ mil inside cash and you will $ billion for the net gain. This has market capitalization from $ billion by .

Lender out of America’s major purchases portray efforts from the providers to help you develop with the the fresh aspects of finance and you may banking or even boost their reach within present organizations. Less than, we try looking in increased detail at the half dozen out-of Lender from America’s foremost purchases. The company will not offer a report on exactly how much cash or money for each and every acquisition currently contributes.

Merrill Lynch

- Buy rates: $50 mil (all-stock exchange)

Financial from America’s purchase of financing and you will money government enterprise Merrill Lynch from inside the 2008 is definitely the company’s prominent. Merrill Lynch is officially built within the 1915 and you can set up along side second century into the one of the greatest financial services people inside the the world.

Financial regarding America’s purchase of Merrill Lynch made the financial institution one to of the biggest riches management people worldwide, approximately $step one.8 trillion from inside the client possessions at the time of closing. Although not, Merrill Lynch’s financing inside the collateralized debt obligations (CDOs) or any other cutting-edge, high-exposure financial products place the business at risk for failure throughout the the newest 2008 overall economy, harmful to get their mother or father on insolvency. Bank regarding The usa is obligated to take plenty of charge and you may develop-offs related to the deal inside the subsequent age. The expense provided Lender regarding America’s settlement from a good $2.4 million group action suit related to the purchase.

You.S. Believe

- Variety of company: Individual financial

- Purchase rate: $3.step three mil

U.S. Believe Corp. was centered from inside the 1853 to incorporate monetary services for personal and you will business funds, having a specific work at highest-net-worth some one. They catered to America’s wealthiest family members and industrialists. When Financial out of America purchased the business of Charles Schwab Corp. for the 2007, U.S. Faith treated about $94 mil for the consumer assets and 21,000 personnel.

The acquisition allowed Bank out of The united states to help you somewhat expand its personal banking company by consolidating U.S. Trust with several people to help make a bigger providers that have $427 mil in total client property. Undergoing obtaining You.S. Faith, Lender of The united states demolished the sooner brand and rebranded the business since You.S. Faith Financial from The usa Personal Riches Government. This department became labeled as Lender off America Individual Lender.

Nationwide Financial

- Version of providers: Financial services

- Order rates: Everything $4 billion (all-inventory exchange)

Nationwide Economic are established in the 1969 and finally grew towards the prominent inventor out-of home mortgages in america. Regardless of if Countrywide’s financial health deteriorated substantially into the 2008 overall economy, Bank out-of The usa viewed the acquisition in an effort to significantly increase the standing in the home home loan field. not, the deal significantly enhanced Financial from America’s experience of home loan financing similar to the You.S. housing industry was collapsing.

Hence, Nationwide turned certainly Lender out of America’s (and the monetary attributes earth’s) terrible acquisitions. Eventually, the acquisition cost Bank from The usa over $34 million inside individual home loss and cash reserved to own payments to people, in addition to $16.eight mil in a scam payment related to Nationwide and you will Merrill Lynch.

FleetBoston Economic

FleetBoston Economic was made in the 1999 by the merger out-of BankBoston and Fleet Financial Category. The company is actually located in The newest The united kingdomt and you can concentrated mostly towards the getting banking properties to own customers regarding Northeast.

Towards purchase of FleetBoston, Bank out of The usa turned within the 2004 next-premier financial team in america, with 33 mil customers and you can dos.5 mil company customers in the dozens of places international. Included in the buy, all the Fleet twigs in the course of time rebranded as the Bank of The united states locations.

LaSalle Lender

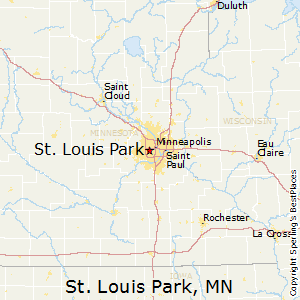

Lender out-of America ordered ABN AMRO United states Holding Co., this new moms and dad organization out of LaSalle Financial, out of ABN AMRO Carrying NV within the later 2007. During the time of the acquisition, LaSalle got a substantial exposure in both consumer and you may commercial banking regarding You.S. Midwest and particularly to Chicago and you can Detroit.

Bank away from America’s purchase of LaSalle aided so you can rather increase its visibility in the area, including 1.cuatro billion retail customers, more 400 financial stores, 264 organizations, and tens and thousands of ATMs regarding il town, Michigan, and you may Indiana.

Axia Technology

Axia Technologies Inc. was built inside the 2015, so it is one of the youngest organizations received by Lender out-of The usa. Axia will bring a gateway and you will critical software provider to have medical care providers in order to helps stop-to-stop repayments https://paydayloanalabama.com/sanford/.

Bank away from America’s purchase of a healthcare financial technology team suggests that it is attempting to move into the brand new punctual-increasing medical money ) has made similar purchases. Inside 2019, JPMorgan gotten InstaMed, a separate medical payments providers.