When the time comes to invest in their lightweight family there are various types of fund offered: signature loans, Camper loans, brand name financing, and you will structure money. Unsecured loans normally have all the way down rates than simply credit cards but want a good credit score scores; Rv funds are specially available for amusement car such as for example RVs and travelling trailers; brand name funds ensure it is buyers to order directly from suppliers at deal prices; and structure finance offer loans into the building techniques to ensure that residents don’t need to shell out upfront will set you back out-of-pouch. Every type of financing features its own pros and cons thus make sure to shop around before making a decision which one was best for you.

To conclude, financing a small household is going to be problematic but there are different options available based what kind of finances and lives you’re looking for. Research your facts beforehand and that means you see all the costs associated with to invest in and you may maintaining a tiny domestic prior to committing oneself economically.

Benefits associated with Located in a small Family

Residing a small family has been ever more popular along the previous long-time. The little proportions and freedom of these land bring of several unique gurus you to definitely complete-measurements of residential property never render. Within this section, we will speak about a number of the great things about residing in a beneficial small house.

Mobile Lives and you will Liberty

One of many grounds anybody love to are now living in a beneficial smaller home is because also offers them the newest versatility to move around while they delight. These types of house are much smaller compared to traditional domiciles, so they are able feel transferred effortlessly with only a truck otherwise truck. This permits men and women to simply take their property using them wherever they wade, providing them to discuss various areas of the nation and you will sense the fresh new metropolitan areas without worrying in the seeking someplace to remain.

An alternative advantage of which have a cellular lifestyle is that you you should never need to bother about are fastened down seriously to one to place. If you get sick of residing in you to place, you can simply clean up their smaller family and you can flow someplace else without having to worry in the promoting your house or looking for an alternative destination to real time.

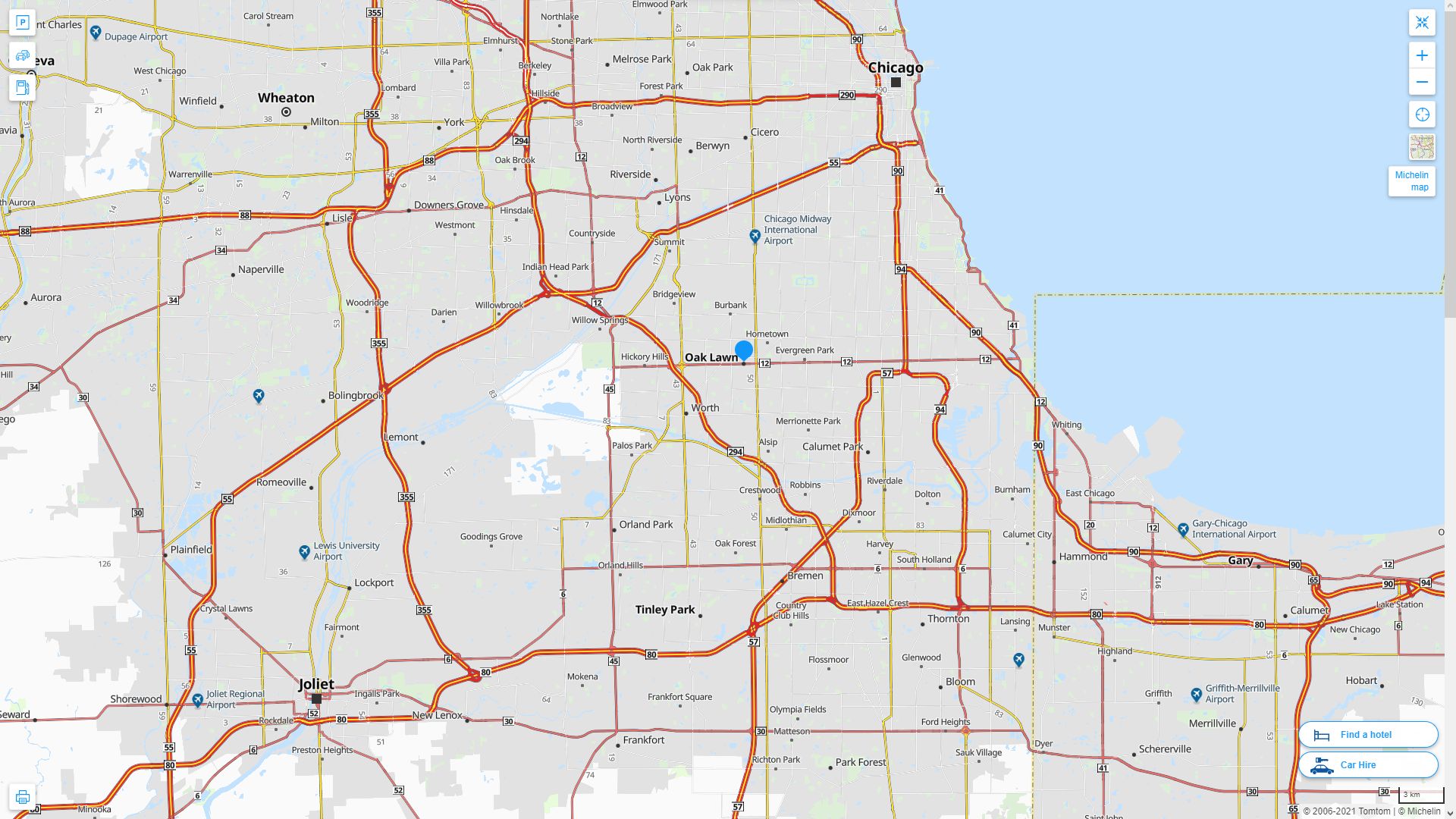

You can’t Playground they Anyplace

Regardless if living in a little domestic also provides benefits, there are also specific downsides that come along with it. One disadvantage is that you are unable to playground they anywhere need. Because these property are so brief, they must be put on land that is zoned to have recreational car (RVs). As a result if you wish to live-in their small domestic full-day, you need to see land that is zoned to have RVs or select an Camper playground that will enable you to park your residence truth be told there enough time-label.

Building Equity

The final advantageous asset of located in a small residence is that it will help your create equity through the years. In the place of traditional properties and this require significant off money and enormous monthly home loan repayments, little home typically want much less initial will cost you and you will reduced monthly repayments. As a result more cash shall be saved monthly instead to be place on the repaying obligations. Throughout the years, it will help build guarantee which can following be taken to other investments or instructions eg to order most home or updating your own lightweight house.

A little residence is a very good way Saybrook Manor loans to call home a conservative lives and you may spend less. Although not, capital a tiny domestic requires careful consideration. There are many different mortgage models readily available that may help you funds your dream little family.

Personal loan

A consumer loan the most preferred a way to finance a small home. Unsecured loans are usually personal loans with fixed interest levels and you may repayment terminology. They don’t need guarantee, you don’t need to build people property so you’re able to safer the loan. Unsecured loans are usually more straightforward to rating than other particular funding and will be taken for each objective, also capital a tiny domestic.