Good principle having understanding settlement costs is this: the low their interest was, more you will pay inside products (that can be used in your settlement costs). The better your own interest rate, the lower their products.

Down Speed, High Settlement costs

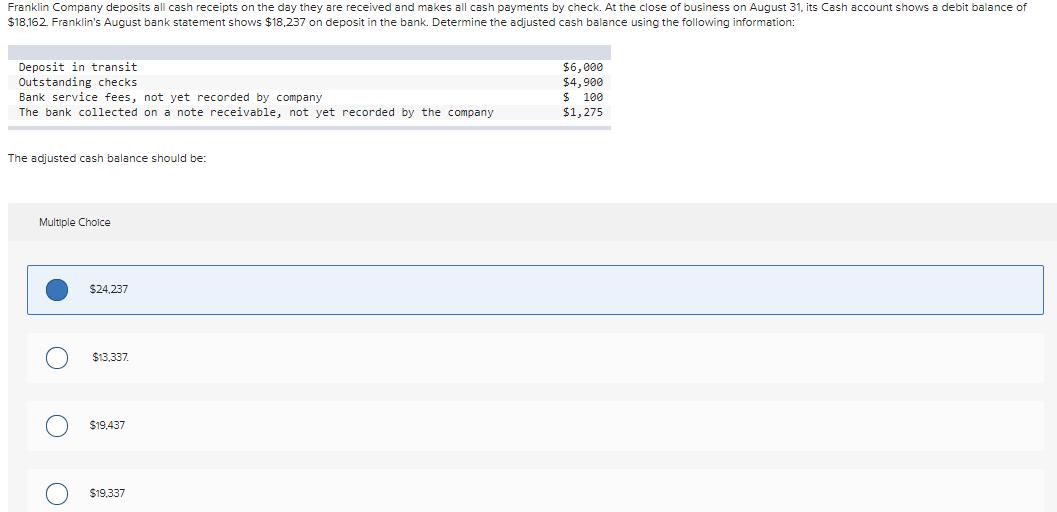

At the time of composing, an average Utah financial price is actually six.105%. Speaking of *types of actual prices. You will see the low the rate considering, the better brand new closing cost.

*Cost over try a good example, and they are maybe not user out of the current pricing. Excite see the current costs with this Get a hold of Your very best Speed Equipment .

Higher rate, All the way down Closing costs

On the other side avoid of your range, you will find exactly how closure that have a higher level can be dramatically take your closing costs off.

*Cost significantly more than are an illustration, and are usually not user away from today’s pricing. Please consider the present cost with the Come across The best Rates Tool .

In some instances, for people who agree to a high adequate rate of interest, you may also get closing costs paid for you, or work as a credit for the your loan. The fresh new disadvantage within these products are a high rate and you will month-to-month commission.

*Cost a lot more than try an illustration, and tend to be perhaps not user out of today’s pricing. Please examine the current costs with your Get a hold of The best Price Device .

We do not imagine settlement costs. I tell you what they’ll be when you employ our very own tool.

7 Suggestions for Negotiating Your Settlement costs

There is absolutely no phenomenal keywords such as for instance, Reducio! that works to compress their settlement costs. However these resources can assist navigate your residence to buy experience so you realize you might be about obtaining the cheapest price you’ll.

step one. Look around : Obtain multiple financing estimates out of different lenders to compare settlement costs. This will help you pick and therefore lender gives the ideal words and you will lower charges. Make sure to evaluate pricing throughout the exact same date, and you will prohibit things such as escrows & prepaids (because the not all the lenders tend to be them, and they’ll function as the exact same wherever your personal their loan).

2. Query How can you allow us to out : Specific settlement costs keeps wiggle space. Query whatever they perform on how to all the way down charge, like loan origination costs, discount issues, appraisals, otherwise underwriting fees.

step 3. Query the seller for concessions : When you are to purchase a property, it makes sense in order to negotiate with the merchant to possess all of them purchase installment loans Alaska a fraction of the settlement costs. This is exactly more likely to occur in a customer’s business. Ask your lender otherwise realtor once they perform prompt otherwise discourage so it in line with the disease.

cuatro. Demand to shut at the conclusion of the fresh month (if possible) : Because of the scheduling your own closure by the end of the day, you might reduce the level of prepaid service appeal, known as per diem interest, that is required at closing.

5. Prefer an effective no-closing-cost home loan : Specific lenders offer mortgage loans for which you favor a high rate that talks about their closing costs. It is not extremely a zero-closure rates mortgage, they are only included in your own borrowing on the interest rate. You generally like this one if you feel pricing will go down ahead of the break-also point. Youre wearing an even more finest condition throughout the brief-term, but you will be trade one for a quicker advantageous financial load within the this new much time-name, if you don’t re-finance to help you less price.

6. Inquire when they offer discounts getting bundled characteristics : Some loan providers and you will term businesses offer discounts if you are using the affiliated characteristics, including identity insurance or escrow characteristics.